Business, 14.12.2019 03:31 thickness3704

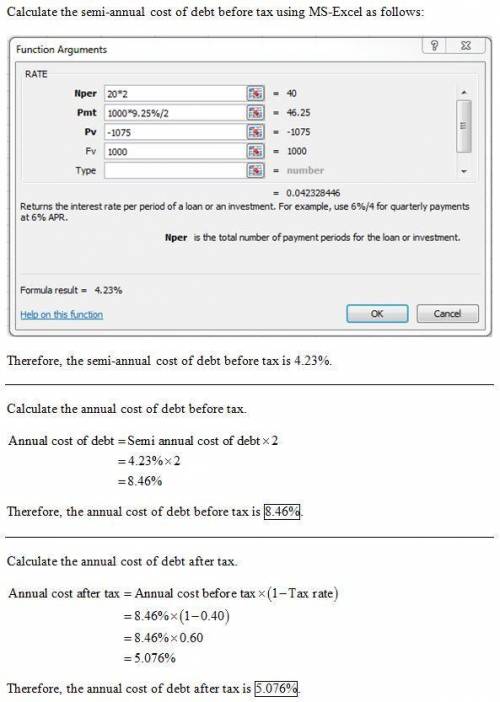

To finance a major expansion, castro chemical company sold a noncallable bond several years ago that now has 20 years to maturity. this bond has a 9.25% annual coupon, paid semiannually, sells at a price of $1,075, and has a par value of $1,000. if the firm's tax rate is 40%, what is the component cost of debt for use in the wacc calculation?

Answers: 2

Another question on Business

Business, 21.06.2019 19:20

Which of the following best explains why large companies have an advantage over smaller companies? a. economies of scale make it possible to offer lower prices. b. the production possibilities frontier is wider for a larger company. c. decreasing marginal utility enables more efficient production. d. increasing the scale of production leads to a reduction in inputs.2b2t

Answers: 1

Business, 22.06.2019 09:00

How does the plaintiff, mrs. wood, try to implicate the gun manufacturer ( who testifies, what do they say, what evidence is introduced)?

Answers: 2

Business, 22.06.2019 16:50

Arestaurant that creates a new type of sandwich is using (blank) as a method of competition.

Answers: 1

Business, 22.06.2019 19:30

Consider the following two projects. both have costs of $5,000 in year 1. project 1 provides benefits of $2,000 in each of the first four years only. the second provides benefits of $2,000 for each of years 6 to 10 only. compute the net benefits using a discount rate of 6 percent. repeat using a discount rate of 12 percent. what can you conclude from this exercise?

Answers: 3

You know the right answer?

To finance a major expansion, castro chemical company sold a noncallable bond several years ago tha...

Questions

History, 15.04.2020 01:01

Mathematics, 15.04.2020 01:01

Mathematics, 15.04.2020 01:01

Mathematics, 15.04.2020 01:01

History, 15.04.2020 01:01

Mathematics, 15.04.2020 01:01