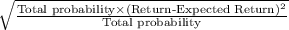

North around, inc. stock is expected to return 22 percent in a boom, 13 percent in a normal economy, and −15 percent in a recession. the probabilities of a boom, normal economy, and a recession are 6 percent, 92 percent, and 2 percent, respectively. what is the standard deviation of the returns on this stock?

Answers: 3

Another question on Business

Business, 22.06.2019 06:30

Select all that apply. select the ways that labor unions can increase wages. collective bargaining reducing the labor supply increasing the demand for labor creating monopolies

Answers: 1

Business, 22.06.2019 08:30

What has caroline's payment history been like? support your answer with two examples

Answers: 3

Business, 22.06.2019 11:00

Acoase solution to a problem of externality ensures that a socially efficient outcome is to

Answers: 2

Business, 22.06.2019 11:20

Mae jong corp. issues $1,000,000 of 10% bonds payable which may be converted into 10,000 shares of $2 par value ordinary shares. the market rate of interest on similar bonds is 12%. interest is payable annually on december 31, and the bonds were issued for total proceeds of $1,000,000. in accounting for these bonds, mae jong corp. will: (a) first assign a value to the equity component, then determine the liability component. (b) assign no value to the equity component since the conversion privilege is not separable from the bond.(c) first assign a value to the liability component based on the face amount of the bond.(d) use the “with-and-without” method to value the compound instrument.

Answers: 3

You know the right answer?

North around, inc. stock is expected to return 22 percent in a boom, 13 percent in a normal economy,...

Questions

Arts, 07.12.2020 22:00

History, 07.12.2020 22:00

Mathematics, 07.12.2020 22:00

Mathematics, 07.12.2020 22:00

Mathematics, 07.12.2020 22:00