Business, 17.12.2019 05:31 hoolio4495

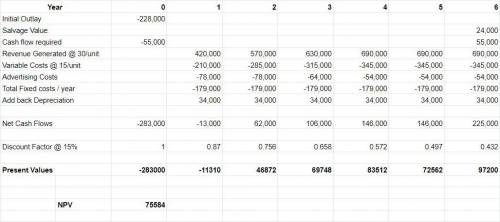

Matheson electronics has just developed a new electronic device that it believes will have broad market appeal. the company has performed marketing and cost studies that revealed the following information: a. new equipment would have to be acquired to produce the device. the equipment would cost $228,000 and have a six-year useful life. after six years, it would have a salvage value of about $24,000.b. sales in units over the next six years are projected to be as follows: year sales in units1 14,0002 19,0003 21,0004–6 23,000c. production and sales of the device would require working capital of $55,000 to finance accounts receivable, inventories, and day-to-day cash needs. this working capital would be released at the end of the project’s life. d. the devices would sell for $30 each; variable costs for production, administration, and sales would be $15 per unit. e. fixed costs for salaries, maintenance, property taxes, insurance, and straight-line depreciation on the equipment would total $179,000 per year. (depreciation is based on cost less salvage value.)f. to gain rapid entry into the market, the company would have to advertise heavily. the advertising costs would be: year amount of yearlyadvertising1–2 $ 78,000 3 $ 64,000 4–6 $ 54,000 g. the company’s required rate of return is 15%.click here to view exhibit 13b-1 and exhibit 13b-2, to determine the appropriate discount factor(s) using tables. required: 1. compute the net cash inflow (incremental contribution margin minus incremental fixed expenses) anticipated from sale of the device for each year over the next six years.2-a. using the data computed in (1) above and other data provided in the problem, determine the net present value of the proposed investment.2-b. would you recommend that matheson accept the device as a new product?

Answers: 1

Another question on Business

Business, 22.06.2019 01:00

Bond x is noncallable and has 20 years to maturity, a 7% annual coupon, and a $1,000 par value. your required return on bond x is 10%; if you buy it, you plan to hold it for 5 years. you (and the market) have expectations that in 5 years, the yield to maturity on a 15-year bond with similar risk will be 9.5%. how much should you be willing to pay for bond x today? (hint: you will need to know how much the bond will be worth at the end of 5 years.) do not round intermediate calculations. round your answer to the nearest cent.

Answers: 3

Business, 22.06.2019 11:00

Specialization—the division of labor—enhances productivity and efficiency by a) allowing workers to take advantage of existing differences in their abilities and skills. b) avoiding the time loss involved in shifting from one production task to another. c) allowing workers to develop skills by working on one, or a limited number, of tasks. d)all of the means identified in the other answers.

Answers: 2

Business, 22.06.2019 11:30

Given the following information about the closed economy of brittania, what is the level of investment spending and private savings, and what is the budget balance? assume there are no government transfers. gdp=$1180.00 million =$510.00 million =$380.00 million =$280.00 million

Answers: 3

Business, 22.06.2019 12:00

In mexico, many garment or sewing shops found they could entice many young people to work for them if they offered clean, air conditioned work areas with high-quality locker rooms to clean up in after the work day. typically, traditional garment shops had to offer to get workers to apply for the hard, repetitive, and somewhat dangerous work. a. benchmark competitive wages b.compensating differentials c. monopoly wages d. wages based on human capital development of each employee

Answers: 3

You know the right answer?

Matheson electronics has just developed a new electronic device that it believes will have broad mar...

Questions

Mathematics, 22.02.2021 18:20

English, 22.02.2021 18:20

Spanish, 22.02.2021 18:20

Mathematics, 22.02.2021 18:20

Mathematics, 22.02.2021 18:20

Mathematics, 22.02.2021 18:20

Mathematics, 22.02.2021 18:20

Computers and Technology, 22.02.2021 18:20

Social Studies, 22.02.2021 18:20

History, 22.02.2021 18:20

Mathematics, 22.02.2021 18:20

Mathematics, 22.02.2021 18:20

Physics, 22.02.2021 18:20