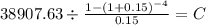

Your company operates a fleet of light trucks that are used to provide contract delivery services. as the engineering and technical manager, you are analyzing the purchase of 55 new trucks as an addition to the fleet. these trucks would be used for a new contract the sales staff is trying to obtain. if purchased, the trucks would cost $21,200 each; estimated use is 20,000 miles per year per truck; estimated operation and maintenance and other related expenses (year-zero dollars) are $0.45 per mile, which is forecasted to increase at the rate of 5% per year; and the trucks are macrs (gds) three-year property class assets. the analysis period is four years; t= 25%; marr = 15% per year (after taxes; includes an inflation component); and the estimated mv at the end of four years (in year-zero dollars) is 35% of the purchase price of the vehicles. this estimate is expected to increase at the rate of 2% per year. based on an after-tax analysis, what is the uniform annual revenue required by your company from the contract to justify these expenditures before any profit is considered? this calculated amount for annual revenue is the breakeven point between purchasing the trucks and which other alternative?

Answers: 1

Another question on Business

Business, 22.06.2019 19:00

It is estimated that over 100,000 students will apply to the top 30 m.b.a. programs in the united states this year. a. using the concept of net present value and opportunity cost, when is it rational for an individual to pursue an m.b.a. degree. b. what would you expect to happen to the number of applicants if the starting salaries of managers with m.b.a. degrees remained constant but salaries of managers without such degrees decreased by 20 percent

Answers: 3

Business, 22.06.2019 19:50

Right medical introduced a new implant that carries a five-year warranty against manufacturer’s defects. based on industry experience with similar product introductions, warranty costs are expected to approximate 2% of sales. sales were $8 million and actual warranty expenditures were $42,750 for the first year of selling the product. what amount (if any) should right report as a liability at the end of the year?

Answers: 2

Business, 22.06.2019 20:50

Lead time for one of your fastest-moving products is 20 days. demand during this period averages 90 units per day.a) what would be an appropriate reorder point? ) how does your answer change if demand during lead time doubles? ) how does your answer change if demand during lead time drops in half?

Answers: 1

Business, 23.06.2019 00:30

Suppose the government decides to issue a new savings bond that is guaranteed to double in value if you hold it for 20 years. assume you purchase a bond that costs $25. a. what is the exact rate of return you would earn if you held the bond for 20 years until it doubled in value? (do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. if you purchased the bond for $25 in 2017 at the then current interest rate of .27 percent year, how much would the bond be worth in 2027? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. in 2027, instead of cashing in the bond for its then current value, you decide to hold the bond until it doubles in face value in 2037. what annual rate of return will you earn over the last 10 years? (do not

Answers: 3

You know the right answer?

Your company operates a fleet of light trucks that are used to provide contract delivery services. a...

Questions

History, 10.01.2021 02:00

Geography, 10.01.2021 02:00

Mathematics, 10.01.2021 02:00

Physics, 10.01.2021 02:00