Business, 18.12.2019 02:31 Chanman40025

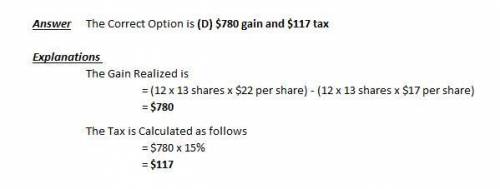

Maren received 12 nqos (each option gives her the right to purchase 13 shares of stock for $10 per share) at the time she started working when the stock price was $8 per share. when the share price was $17 per share, she exercised all of her options. eighteen months later she sold all of the shares for $22 per share. how much gain will maren recognize on the sale and how much tax will she pay assuming her marginal tax rate is 35 percent and long-term capital gains rate is 15 percent? ?

a. $1,872 gain and $281 tax.

b. $0 gain and $0 tax

c. $780gain and $273 tax

d. $780 gain and $117 tax

Answers: 3

Another question on Business

Business, 22.06.2019 11:00

Why does an organization prepare a balance sheet? a. to reveal what the organization owns and owes at a point in time b. to reveal how well the company utilizes its cash c. to calculate retained earnings for a given accounting period d. to calculate gross profit for a given accounting period

Answers: 1

Business, 22.06.2019 15:00

(a) what was the opportunity cost of non-gm food for many buyers before 2008? (b) why did they prefer the alternative? (c) what was the opportunity cost in 2008? (d) why did it change?

Answers: 2

Business, 23.06.2019 01:30

You need $87,000 in 12 years. required: if you can earn .54 percent per month, how much will you have to deposit today?

Answers: 2

Business, 23.06.2019 15:30

Bill is 31 years old, married, and lived with his spouse michelle from january 2018 to september 2018. bill paid all the cost of keeping up his home. he indicated that he is not legally separated and he and michelle agreed they will not a file a joint return. bill has an 8-year-old son, daniel, who qualifies as bill's dependent. bill worked as a clerk and his wages are $20,000 for 2018. his income tax before credits is $500. in 2018, he took a computer class at the local university to improve his job skills. bill has a receipt showing he paid $1,200 for tuition. he paid for all his educational expenses and did not receive any assistance or reimbursement. bill does not have enough deductions to itemize. bill, michelle, and daniel are u.s. citizens with valid social security numbers. 8. bill does not qualify to claim which of the following: a. head of household b. education benefit c. earned income credit d. all of the above

Answers: 3

You know the right answer?

Maren received 12 nqos (each option gives her the right to purchase 13 shares of stock for $10 per s...

Questions

Mathematics, 11.11.2020 02:10

Physics, 11.11.2020 02:10

English, 11.11.2020 02:10

Mathematics, 11.11.2020 02:10

Mathematics, 11.11.2020 02:10

Social Studies, 11.11.2020 02:10

Mathematics, 11.11.2020 02:10

Biology, 11.11.2020 02:10

Mathematics, 11.11.2020 02:10