On july 1, 2017, crane inc. made two sales.

1. it sold land having a fair value of $915,...

Business, 18.12.2019 03:31 jessieeverett432

On july 1, 2017, crane inc. made two sales.

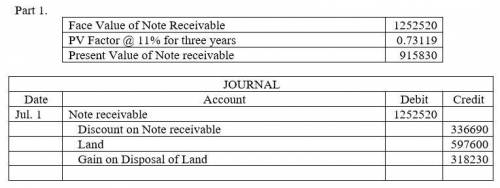

1. it sold land having a fair value of $915,830 in exchange for a 3-year zero-interest-bearing promissory note in the face amount of $1,252,520. the land is carried on agincourt’s books at a cost of $597,600.

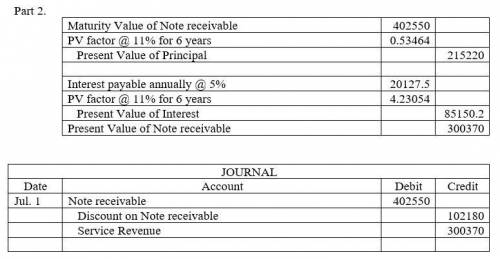

2. it rendered services in exchange for a 5%, 6-year promissory note having a face value of $402,550 (interest payable annually).

crane inc. recently had to pay 8% interest for money that it borrowed from british national bank. the customers in these two transactions have credit ratings that require them to borrow money at 11% interest.

record the two journal entries that should be recorded by crane inc. for the sales transactions above that took place on july 1, 2017. (round present value factor calculations to 5 decimal places, e. g. 1.25124 and final answers to 0 decimal places, e. g. 5,275. if no entry is required, select "no entry" for the account titles and enter 0 for the amounts. credit account titles are automatically indented when the amount is entered. do not indent manually.)

Answers: 1

Another question on Business

Business, 22.06.2019 13:40

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

Business, 22.06.2019 16:10

The brs corporation makes collections on sales according to the following schedule: 30% in month of sale 66% in month following sale 4% in second month following sale the following sales have been budgeted: sales april $ 130,000 may $ 150,000 june $ 140,000 budgeted cash collections in june would be:

Answers: 1

Business, 22.06.2019 19:00

Question 55 ted, a supervisor for jack's pool supplies, was accused of stealing pool supplies and selling them to friends and relatives at reduced prices. given ted's earlier track record, he was not fired immediately. the authorities decided to give him an administrative leave, without pay, until the investigation was complete. in view of the given information, it would be most appropriate to say that ted was: demoted. discharged. suspended. dismissed.

Answers: 2

Business, 22.06.2019 20:00

With the slowdown of business, how can starbucks ensure that the importance of leadership development does not get overlooked?

Answers: 3

You know the right answer?

Questions

History, 03.02.2021 17:30

Mathematics, 03.02.2021 17:30

History, 03.02.2021 17:30

Mathematics, 03.02.2021 17:30

Mathematics, 03.02.2021 17:30

Mathematics, 03.02.2021 17:30

History, 03.02.2021 17:30

Mathematics, 03.02.2021 17:30

Mathematics, 03.02.2021 17:30

Mathematics, 03.02.2021 17:30

Mathematics, 03.02.2021 17:30

Mathematics, 03.02.2021 17:30

Mathematics, 03.02.2021 17:30