Doyle’s candy company is a wholesale distributor of candy. the company services groceries, convenience stores and drugstores in a large metropolitan area. small but steady growth in sales has been achieved over the past few years while candy prices have been increasing. the company is formulating i its plans for the coming fiscal year. presented below are the data used to project the current year’s after-tax net income of $264960.average selling price $9.60 per boxaverage variable cost: candy production $4.80 per boxselling expense .96 per boxtotal $5.76 per boxannual fixed costs: selling $384,000administrative 672,000total 1056000expected annual sales volume 390,000 boxestax rate 40%manufactures of candy have announced that they will increase prices of their products an average 15 percent in the coming year due to increasein raw materials (sugar, cocoa, peanuts, etc.) and labor costs. doyle’s candy company expects that all other costs will remain at the same rates or levels as the current year.

required:

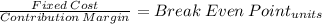

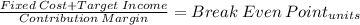

a. what is doyles candy company’s break-even point in boxes of candy for the current year? b. what selling price per box must doyle’s candy company change to cover the 15 percent increase in variable production costs of candyand still maintain the current contribution margin percentage? c. what volume of sales in dollars must doyle’s candy company achieve in the coming year to maintain the same net income after taxes as projected for the current year if the selling price of candy remains at $9.60 per box and the variable production costs of candy increase 15 percent?

Answers: 3

Another question on Business

Business, 21.06.2019 22:40

Lincoln company has an accounting policy for internal reporting purposes whereby the costs of any research and development projects that are over 70 percent likely to succeed are capitalized and then depreciated over a five-year period with a full year of depreciation in the year of capitalization. in the current year, $400,000 was spent on project one, and it was 55 percent likely to succeed, $600,000 was spent on project two, and it was 65 percent likely to succeed, and $900,000 was spent on project three, and it was 75 percent likely to succeed. in converting the internal financial statements to external financial statements, by how much will net income for the current year have to be reduced? a. $180,000b. $380,000c. $720,000d. $900,000

Answers: 3

Business, 22.06.2019 01:30

Side bar toggle icon performance in last 10 qs hard easy performance in last 10 questions - there are '3' correct answers, '3' wrong answers, '0' skipped answers, '1' partially correct answers about this question question difficulty difficulty 60% 42.2% students got it correct study this topic • demonstrate an understanding of sampling distributions question number q 3.8: choose the correct estimate for the standard error using the 95% rule.

Answers: 2

Business, 22.06.2019 07:30

Which two of the following are benefits of consumer programs

Answers: 1

Business, 22.06.2019 07:30

When the national economy goes from bad to better, market research shows changes in the sales at various types of restaurants. projected 2011 sales at quick-service restaurants are $164.8 billion, which was 3% better than in 2010. projected 2011 sales at full-service restaurants are $184.2 billion, which was 1.2% better than in 2010. how will the dollar growth in quick-service restaurants sales compared to the dollar growth for full-service places?

Answers: 2

You know the right answer?

Doyle’s candy company is a wholesale distributor of candy. the company services groceries, convenien...

Questions

History, 27.04.2021 02:50

Mathematics, 27.04.2021 02:50

Mathematics, 27.04.2021 02:50

Mathematics, 27.04.2021 02:50

Mathematics, 27.04.2021 02:50

Geography, 27.04.2021 02:50

Mathematics, 27.04.2021 02:50

Social Studies, 27.04.2021 02:50

Mathematics, 27.04.2021 02:50

Engineering, 27.04.2021 02:50

Computers and Technology, 27.04.2021 02:50

Mathematics, 27.04.2021 02:50