Business, 20.12.2019 01:31 mikaelalcool1

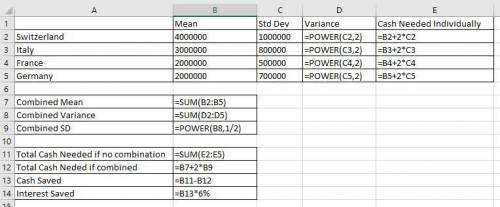

International finance problem set on working capital management1. rossignol co. manufactures and sells skis and snowboards in france, switzerland and italy, and also maintains a corporate account in frankfurt, germany. rossignol has been setting separate operating cash balances in each country at a level equal to expected cash needs plus two standard deviations above those needs, based on a statistical analysis of cash flow volatility. expected operating cash needs and one standard deviation of those needs are below. rossignol’s frankfurt bank suggests that the same level of safety could be maintained if all precautionary balances were combined in a central account at the frankfurt headquarters. a. how much lower would rossignol’s total cash balances be if all precautionary balances were combined? assume cash needs in each country are normally distributed and are independent of each other. b. how much would the company save annually, if financing costs are 6% p. a., from centralizing its cash holdings?

Answers: 3

Another question on Business

Business, 22.06.2019 17:30

Costco wholesale corporation operates membership warehouses selling food, appliances, consumer electronics, apparel and other household goods at 471 locations across the u.s. as well as in canada, mexico and puerto rico. as of its fiscal year-end 2005, costco had approximately 21.2 million members. selected fiscal-year information from the company's balance sheets follows. ($ millions). selected balance sheet data 2005 2004 merchandise inventories $4,015 $3,644 deferred membership income (liability) 501 454 (a) during fiscal 2005, costco collected $1,120 cash for membership fees. use the financial statement effectstemplate to record the cash collected for membership fees. (b) in 2005, costco recorded $46,347 million in merchandise costs (that is, cost of goods sold). record thistransaction in the financial statement effects template. (c) determine the value of merchandise that costco purchased during fiscal-year 2005. use the financial statementeffects template to record these merchandise purchases. assume all of costco's purchases are on credit.

Answers: 3

Business, 22.06.2019 20:00

Experienced problem solvers always consider both the value and units of their answer to a problem. why?

Answers: 3

Business, 22.06.2019 22:40

Colorado rocky cookie company offers credit terms to its customers. at the end of 2018, accounts receivable totaled $715,000. the allowance method is used to account for uncollectible accounts. the allowance for uncollectible accounts had a credit balance of $50,000 at the beginning of 2018 and $30,000 in receivables were written off during the year as uncollectible. also, $3,000 in cash was received in december from a customer whose account previously had been written off. the company estimates bad debts by applying a percentage of 15% to accounts receivable at the end of the year. 1. prepare journal entries to record the write-off of receivables, the collection of $3,000 for previously written off receivables, and the year-end adjusting entry for bad debt expense.2. how would accounts receivable be shown in the 2018 year-end balance sheet?

Answers: 1

Business, 23.06.2019 03:20

Name successful entrepreneurs from your area whose business is related to cookery

Answers: 1

You know the right answer?

International finance problem set on working capital management1. rossignol co. manufactures and sel...

Questions

Mathematics, 14.10.2020 15:01

Chemistry, 14.10.2020 15:01

History, 14.10.2020 15:01

Mathematics, 14.10.2020 15:01

Mathematics, 14.10.2020 15:01

Geography, 14.10.2020 15:01

Physics, 14.10.2020 15:01

Mathematics, 14.10.2020 15:01

Mathematics, 14.10.2020 15:01

Health, 14.10.2020 15:01

English, 14.10.2020 15:01

Chemistry, 14.10.2020 15:01

Social Studies, 14.10.2020 15:01