Business, 20.12.2019 02:31 ortizprecious5183

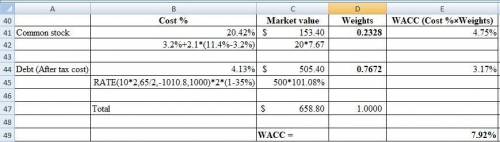

Calculate the wacc for ttt. assume ttt is in the 35% tax bracket. ttt has $500 million face value of debt outstanding. the debt has a price of 101: 08, a coupon of 6 ½ % (coupons are paid semi-annually), and a maturity of 10 years. ttt has 20 million shares of stock outstanding. the shares are currently priced at $7.67. the company pays no dividend, but estimates of the company’s beta are 2.1. the current risk-free rate is 3.2%, and the rate of return on the market portfolio is 11.4%.

Answers: 3

Another question on Business

Business, 22.06.2019 02:30

Consider the local telephone company, a natural monopoly. the following graph shows the monthly demand curve for phone services and the company’s marginal revenue (mr), marginal cost (mc), and average total cost (atc) curves. 0 2 4 6 8 10 12 14 16 18 20 100 90 80 70 60 50 40 30 20 10 0 price (dollars per subscription) quantity (thousands of subscriptions) d mr mc atc 8, 60 suppose that the government has decided not to regulate this industry, and the firm is free to maximize profits, without constraints. complete the first row of the following table. pricing mechanism short run long-run decision quantity price profit (subscriptions) (dollars per subscription) profit maximization marginal-cost pricing average-cost pricing suppose that the government forces the monopolist to set the price equal to marginal cost. complete the second row of the previous table. suppose that the government forces the monopolist to set the price equal to average total cost. complete the third row of the previous table. under average-cost pricing, the government will raise the price of output whenever a firm’s costs increase, and lower the price whenever a firm’s costs decrease. over time, under the average-cost pricing policy, what will the local telephone company most likely do

Answers: 2

Business, 22.06.2019 03:30

Assume that all of thurmond company’s sales are credit sales. it has been the practice of thurmond company to provide for uncollectible accounts expense at the rate of one-half of one percent of net credit sales. for the year 20x1 the company had net credit sales of $2,021,000 and the allowance for doubtful accounts account had a credit balance, before adjustments, of $630 as of december 31, 20x1. during 20x2, the following selected transactions occurred: jan. 20 the account of h. scott, a deceased customer who owed $325, was determined to be uncollectible and was therefore written off. mar. 16 informed that a. nettles, a customer, had been declared bankrupt. his account for $898 was written off. apr. 23 the $906 account of j. kenney & sons was written off as uncollectible. aug. 3 wrote off as uncollectible the $750 account of clarke company. oct. 20 wrote off as uncollectible the $1,130 account of g. michael associates. oct. 27 received a check for $325 from the estate of h. scott. this amount had been written off on january 20 of the current year. dec. 20 cater company paid $7,000 of the $7,500 it owed thurmond company. since cater company was going out of business, the $500 balance it still owed was deemed uncollectible and written off. required: prepare journal entries for the december 31, 20x1, and the seven 20x2 transactions on the work sheets provided at the back of this unit. then answer questions 8 and 9 on the answer sheet. t-accounts are also provided for your use in answering these questions. 8. which one of the following entries should have been made on december 31, 20x1?

Answers: 1

Business, 22.06.2019 12:00

Suppose there are three types of consumers who attend concerts at your university’s performing arts center: students, staff, and faculty. each of these groups has a different willingness to pay for tickets; within each group, willingness to pay is identical. there is a fixed cost of $1,000 to put on a concert, but there are essentially no variable costs. for each concert: i. there are 140 students willing to pay $20. (ii) there are 200 staff members willing to pay $35. (iii) there are 100 faculty members willing to pay $50. a) if the performing arts center can charge only one price, what price should it charge? what are profits at this price? b) if the performing arts center can price discriminate and charge two prices, one for students and another for faculty/staff, what are its profits? c) if the performing arts center can perfectly price discriminate and charge students, staff, and faculty three separate prices, what are its profits?

Answers: 1

Business, 22.06.2019 19:50

What is the present value of the following cash flow stream at a rate of 12.0%? years: 0 1 2 3 4| | | | |cfs: $0 $1,500 $3,000 $4,500 $6,000a. $9,699b. $10,210c. $10,747d. $11,284e. $11,849

Answers: 3

You know the right answer?

Calculate the wacc for ttt. assume ttt is in the 35% tax bracket. ttt has $500 million face value of...

Questions

History, 05.09.2019 01:10

Mathematics, 05.09.2019 01:10

Mathematics, 05.09.2019 01:10

Mathematics, 05.09.2019 01:10

Mathematics, 05.09.2019 01:10

Mathematics, 05.09.2019 01:10

Mathematics, 05.09.2019 01:10

History, 05.09.2019 01:10

Mathematics, 05.09.2019 01:10