Business, 20.12.2019 03:31 yourgirlnevaeh

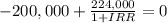

Assume that you are a vending machine dealer. you plan to purchase a vending machine for $200,000. one year later, you are expected to sell it back and receive $224,000 as cash. what is the irr (internal rate of return) on this investment? be sure to apply the definition of irr and show your work.

3 points>

in order to buy the vending machine, you plan on borrowing $80,000 from bank at 5% of interest rate and raise $120,000 from investors at 10% of cost of equity, are you going to accept this project? why? (tax rate is 30%). show your work.

Answers: 2

Another question on Business

Business, 23.06.2019 00:00

How much is a 2019 tesla? ? exact price trying to buy for my 6 year old sister

Answers: 2

Business, 23.06.2019 12:50

Of the following combinations of financial instruments, which depicts the correct ranking of high to low risk (moving from left to right)? commercial paper; preferred stock; bankers' acceptances state & local government bonds; u.s. treasury bonds; aaa-rated corporate bonds common stock; leases; u.s. treasury notes preferred stock; common stock; u.s. treasury bills

Answers: 1

Business, 23.06.2019 20:30

Explain the concept of borrowed equity as it relates to an event sponsor. the concept of borrowed equity is when a sponsor does something such as make the team's uniforms or pay for the event venue and in return they are able to advertise their brand during the event or on flyers and things of that nature.

Answers: 1

You know the right answer?

Assume that you are a vending machine dealer. you plan to purchase a vending machine for $200,000. o...

Questions

History, 09.11.2020 21:20

English, 09.11.2020 21:20

Biology, 09.11.2020 21:20

Mathematics, 09.11.2020 21:20

Mathematics, 09.11.2020 21:20

Mathematics, 09.11.2020 21:20

Mathematics, 09.11.2020 21:20

History, 09.11.2020 21:20