Business, 20.12.2019 03:31 churchlady114p2met3

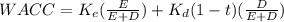

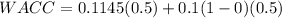

Abc co. and xyz co. are identical firms in all respects except for their capital structure. abc is all equity financed with $550,000 in stock. xyz uses both stock and perpetual debt; its stock is worth $275,000 and the interest rate on its debt is 10 percent. both firms expect ebit to be $59,000. ignore taxes. a. rico owns $33,000 worth of xyz’s stock. what rate of return is he expecting? (round your answer to 2 decimal places. (e. g., 32.16)) rate of return % b. suppose rico invests in abc co and uses homemade leverage. calculate his total cash flow and rate of return. (round your percentage answer to 2 decimal places. (e. g., 32.16)) total cash flow $ rate of return %c. what is the cost of equity for abc and xyz? (round your answers to 2 decimal places. (e. g., 32.16)) cost of equity abc % xyz % d. what is the wacc for abc and xyz? (round your answers to 2 decimal places. (e. g., 32.16)) wacc abc % xyz %

Answers: 3

Another question on Business

Business, 21.06.2019 20:30

Agood for which demand increases as income rises is and a good for which demand increases as income falls is

Answers: 1

Business, 22.06.2019 08:00

Why do police officers get paid less than professional baseball players?

Answers: 2

Business, 22.06.2019 11:30

4. chef a says that broth should be brought to a boil. chef b says that broth should be kept at an even, gentle simmer. which chef is correct? a. neither chef is correct. b. chef a is correct. c. both chefs are correct. d. chef b is correct. student c incorrect which is right answer

Answers: 2

Business, 23.06.2019 01:30

How is systematic decision making related to being financially responsible

Answers: 1

You know the right answer?

Abc co. and xyz co. are identical firms in all respects except for their capital structure. abc is a...

Questions

Mathematics, 27.06.2019 10:00

History, 27.06.2019 10:00

Mathematics, 27.06.2019 10:00

Mathematics, 27.06.2019 10:00

Chemistry, 27.06.2019 10:00

History, 27.06.2019 10:00

Mathematics, 27.06.2019 10:00

Mathematics, 27.06.2019 10:00

History, 27.06.2019 10:00

Mathematics, 27.06.2019 10:00

Mathematics, 27.06.2019 10:00

Mathematics, 27.06.2019 10:00

Biology, 27.06.2019 10:00