Business, 20.12.2019 05:31 zylandriawilliams

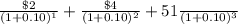

Acompany will pay a $2 per share dividend in 1 year. the dividend in 2 years will be $4 per share, and it is expected that dividends will grow at 2% per year thereafter. the expected rate of return on the stock is 10%. a. what is the current price of the stock?

Answers: 3

Another question on Business

Business, 22.06.2019 02:00

What is an example of a good stock to buy in a recession? a) cyclical stock b) defensive stock c) income stock d) bond

Answers: 1

Business, 22.06.2019 18:10

Consumers who participate in the sharing economy seem willing to interact with total strangers. despite safety and privacy concerns, what do you think is the long-term outlook for this change in the way we think about interacting with people whom we don't know? how can businesses to diminish worries some people may have about these practices?

Answers: 1

Business, 22.06.2019 19:00

Gus needs to purée his soup while it's still in the pot. what is the best tool for him to use? a. potato masher b. immersion blender c. rotary mixer d. whisk

Answers: 2

Business, 22.06.2019 20:30

Contrast two economies that transitioned to capitalism and explain what factors affected the ease kf their transition as welas the “face” of capitalism that each has adopted

Answers: 2

You know the right answer?

Acompany will pay a $2 per share dividend in 1 year. the dividend in 2 years will be $4 per share, a...

Questions

History, 30.08.2019 17:00

Mathematics, 30.08.2019 17:00

Mathematics, 30.08.2019 17:00

Physics, 30.08.2019 17:00

Social Studies, 30.08.2019 17:00

Health, 30.08.2019 17:00

Mathematics, 30.08.2019 17:00

English, 30.08.2019 17:00

Physics, 30.08.2019 17:00

Chemistry, 30.08.2019 17:00

Mathematics, 30.08.2019 17:00

Mathematics, 30.08.2019 17:00

Spanish, 30.08.2019 17:00

Chemistry, 30.08.2019 17:00