Business, 21.12.2019 06:31 cdjeter12oxoait

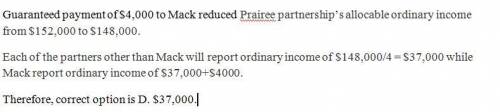

Prairie partnership has four equal partners, dodd, crank, pick, and mack. each of the partners had a tax basis of $320,000 as of january 1, 20x5. prairie’s 20x5 ordinary business income was $152,000 before deducting any guaranteed payments to the partners. during 20x5, prairie paid mack guaranteed payments of $4,000 for deductible services rendered. during 20x5, each of the four partners took a distribution of $50,000. what is mack’s tax basis in prairie on december 31, 20x5?

Answers: 2

Another question on Business

Business, 21.06.2019 20:20

Jimmy owns an ice cream parlor. he designs a schedule for the different tasks the employees have to perform in order to prevent monotony at work. according to the schedule, if an employee makes waffle cones on a day, he serves ice creams the next day and clears the tables on the day after that. jimmy is using the approach at his ice cream parlor.

Answers: 2

Business, 22.06.2019 08:30

Blank is the internal operation that arranges information resources to support business performance and outcomes

Answers: 2

Business, 22.06.2019 10:40

Why do you think the compensation plans differ at the two firms? in particular, why do you think kaufmann’s pays commissions to salespeople, while parkleigh does not? why does parkleigh offer employees discounts on purchases, while kaufmann’s does not?

Answers: 3

You know the right answer?

Prairie partnership has four equal partners, dodd, crank, pick, and mack. each of the partners had a...

Questions

Mathematics, 07.12.2020 19:20

Social Studies, 07.12.2020 19:20

Chemistry, 07.12.2020 19:20

Mathematics, 07.12.2020 19:20

Physics, 07.12.2020 19:20

Spanish, 07.12.2020 19:20

Chemistry, 07.12.2020 19:20

English, 07.12.2020 19:20

Physics, 07.12.2020 19:20