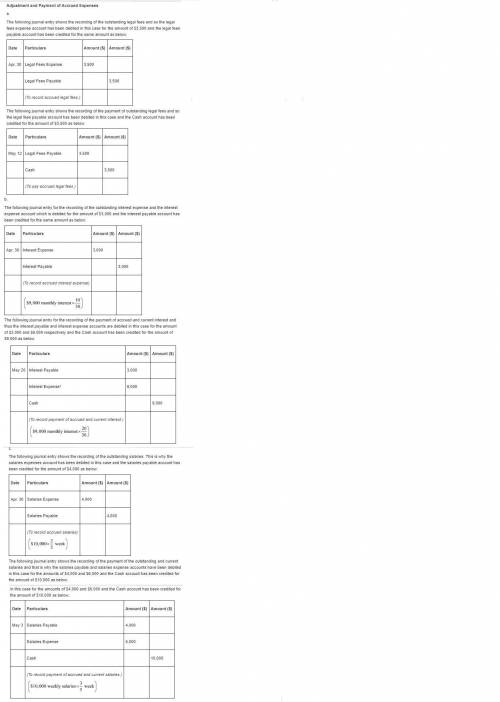

A. on april 1, the company retained an attorney for a flat monthly fee of $3,500. payment for april legal services was made by the company on may 12.b. a $900,000 note payable requires 12% annual interest, or $9,000, to be paid at the 20th day of each month. the interest was last paid on april 20, and the next payment is due on may 20. as of april 30, $3,000 of interest expense has accrued. c. total weekly salaries expense for all employees is $10,000. this amount is paid at the end of the day on friday of each five-day workweek. april 30 falls on a tuesday, which means that the employees had worked two days since the last payday. the next payday is may 3. required: 1. the above three separate situations require adjusting journal entries to prepare financial statements as of april 30. 2. for each situation, present both: i. the april 30 adjusting entry. ii. the subsequent entry during may to record payment of the accrued expenses.

Answers: 1

Another question on Business

Business, 22.06.2019 01:00

Bond x is noncallable and has 20 years to maturity, a 7% annual coupon, and a $1,000 par value. your required return on bond x is 10%; if you buy it, you plan to hold it for 5 years. you (and the market) have expectations that in 5 years, the yield to maturity on a 15-year bond with similar risk will be 9.5%. how much should you be willing to pay for bond x today? (hint: you will need to know how much the bond will be worth at the end of 5 years.) do not round intermediate calculations. round your answer to the nearest cent.

Answers: 3

Business, 22.06.2019 03:30

Used cars usually have options: higher depreciation rate than new cars lower financing costs than new cars lower insurance premiums than new cars lower maintenance costs than new cars

Answers: 1

Business, 22.06.2019 16:20

Stosch company's balance sheet reported assets of $112,000, liabilities of $29,000 and common stock of $26,000 as of december 31, year 1. if retained earnings on the balance sheet as of december 31, year 2, amount to $74,000 and stosch paid a $28,000 dividend during year 2, then the amount of net income for year 2 was which of the following? a)$23,000 b) $35,000 c) $12,000 d)$42,000

Answers: 1

Business, 22.06.2019 19:50

Juan's investment portfolio was valued at $125,640 at the beginning of the year. during the year, juan received $603 in interest income and $298 in dividend income. juan also sold shares of stock and realized $1,459 in capital gains. juan's portfolio is valued at $142,608 at the end of the year. all income and realized gains were reinvested. no funds were contributed or withdrawn during the year. what is the amount of income juan must declare this year for income tax purposes?

Answers: 1

You know the right answer?

A. on april 1, the company retained an attorney for a flat monthly fee of $3,500. payment for april...

Questions

History, 29.01.2020 08:49

Mathematics, 29.01.2020 08:49

Biology, 29.01.2020 08:49

Social Studies, 29.01.2020 08:49

History, 29.01.2020 08:49

Mathematics, 29.01.2020 08:49

Mathematics, 29.01.2020 08:49

Chemistry, 29.01.2020 08:49

English, 29.01.2020 08:49

Mathematics, 29.01.2020 08:49

Mathematics, 29.01.2020 08:49

Mathematics, 29.01.2020 08:49

History, 29.01.2020 08:49

Mathematics, 29.01.2020 08:49