Business, 23.12.2019 23:31 heavenmckissack21

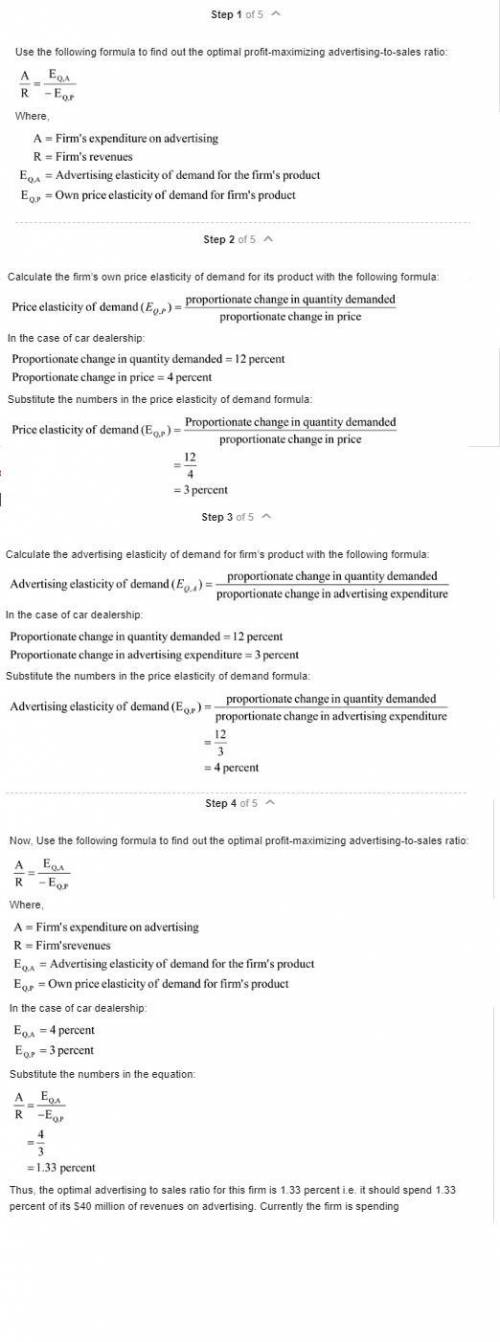

Last month you assumed the position of manager for a large car dealership. the distinguishing feature of this dealership is its "no hassle" pricing strategy; prices (usually well below the sticker price) are posted on the windows, and your sales staff has a reputation for not negotiating with customers. last year, your company spent $2 million on advertisements to inform customers about its "no hassle" policy, and had overall sales revenue of $40 million. a recent study from an agency on madison avenue indicates that, for each 3 percent increase in tv advertising expenditures, a car dealer can expect to sell 12 percent more cars—but that it would take a 4 percent decrease in price to generate the same 12 percent increase in units sold. assuming the information from madison avenue is correct, should you increase or decrease your firm’s level of advertising? explain.

Answers: 2

Another question on Business

Business, 21.06.2019 17:40

Anne is comparing savings accounts. one account has an interest rate of 1.2 percent compounded yearly, and one account has an interest rate of 1.2 percent compounded monthly. which account will earn more money in interest? the account that earns 1.2 percent compounded yearly the account that earns 1.2 percent compounded monthly

Answers: 2

Business, 22.06.2019 03:00

Compare the sources of consumer credit 1. consumers use a prearranged loan using special checks 2. consumers use cards with no interest and non -revolving balances 3. consumers pay off debt and credit is automatically renewed 4. consumers take out a loan with a repayment date and have a specific purpose a. travel and entertainment credit b. revolving check credit c. closed-end credit d. revolving credit

Answers: 1

Business, 22.06.2019 05:00

Identify an organization with the low-total-cost value proposition and suggest at least two possible measures within each of the four balanced scorecard perspectives.

Answers: 3

Business, 22.06.2019 06:10

Investment x offers to pay you $5,700 per year for 9 years, whereas investment y offers to pay you $8,300 per year for 5 years. if the discount rate is 6 percent, what is the present value of these cash flows? (do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) present value investment x $ investment y $ if the discount rate is 16 percent, what is the present value of these cash flows? (do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) present value investment x $ investment y

Answers: 1

You know the right answer?

Last month you assumed the position of manager for a large car dealership. the distinguishing featur...

Questions

Chemistry, 17.02.2021 05:10

Mathematics, 17.02.2021 05:10

Mathematics, 17.02.2021 05:10

Mathematics, 17.02.2021 05:10

Mathematics, 17.02.2021 05:10

Health, 17.02.2021 05:10

Social Studies, 17.02.2021 05:10

Chemistry, 17.02.2021 05:10

History, 17.02.2021 05:10

History, 17.02.2021 05:10