Business, 24.12.2019 00:31 thu651777p0vibf

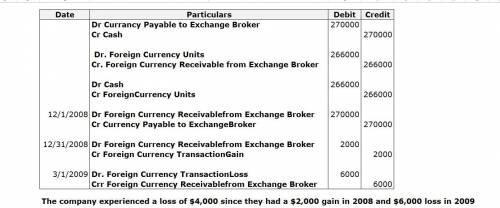

On december 1, 2008, secure company bought a 90-day forward contract to purchase 200,000 euros (€) at a forward rate of €1 = $1.35 when the spot rate was $1.33. other exchange rates were as follows: spot forward rate for rate march 1, 2009 december 31, 2008 $ 1.34 $ 1.36 march 1, 2009 1.33 required: 1. prepare all journal entries related to secure company's foreign currency speculation from december 1, 2008, through march 1, 2009, assuming the fiscal year ends on december 31, 2008. 2. 2. did the company gain or lose on its purchase of the forward contract?

Answers: 1

Another question on Business

Business, 22.06.2019 18:00

Rosie and her brother michael decided recently to purchase an rv together. they both want to use the rv to take their families camping. the price of the rv was $10,000. since michael expects to use the rv 60% of the time and rosie 40% of the time, michael contributed $6,000 and rosie contributed $4,000. their ownership percentage equals their contribution percentage. which type of property titling should they use to reflect their ownership interest?

Answers: 1

Business, 22.06.2019 18:30

You should typically prepare at least questions for the people who will host you during a job shadow. a. 3 b. 4 c. 5 d. 2

Answers: 1

Business, 22.06.2019 19:30

Quick calculate the roi dollar amount and percentage for these example investments. a. you invest $50 in a government bond that says you can redeem it a year later for $55. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage. b. you invest $200 in stocks and sell them one year later for $230. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage.

Answers: 2

Business, 22.06.2019 22:40

Rolston music company is considering the sale of a new sound board used in recording studios. the new board would sell for $27,200, and the company expects to sell 1,570 per year. the company currently sells 2,070 units of its existing model per year. if the new model is introduced, sales of the existing model will fall to 1,890 units per year. the old board retails for $23,100. variable costs are 57 percent of sales, depreciation on the equipment to produce the new board will be $1,520,000 per year, and fixed costs are $1,420,000 per year.if the tax rate is 35 percent, what is the annual ocf for the project?

Answers: 1

You know the right answer?

On december 1, 2008, secure company bought a 90-day forward contract to purchase 200,000 euros (€) a...

Questions

History, 30.11.2020 21:10

Mathematics, 30.11.2020 21:10

Social Studies, 30.11.2020 21:10

Mathematics, 30.11.2020 21:10

English, 30.11.2020 21:10

Mathematics, 30.11.2020 21:10

Mathematics, 30.11.2020 21:10

Mathematics, 30.11.2020 21:10

Physics, 30.11.2020 21:10

Mathematics, 30.11.2020 21:10

Social Studies, 30.11.2020 21:10

Mathematics, 30.11.2020 21:10

Mathematics, 30.11.2020 21:10