Business, 24.12.2019 18:31 bankscorneliuso39

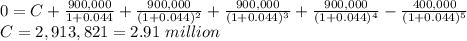

An investor is considering a project that will generate $900,000 per year for four years. in addition to upfront costs, at the completion of the project at the end of the fifth year there will be shut-down costs of $400,000 . if the cost of capital is 4.4%, based on the mirr, at what upfront costs does this project cease to be worthwhile? a) $2.62 millionb) $3.21 millionc) $2.91 milliond) $3.50 million

Answers: 1

Another question on Business

Business, 22.06.2019 13:30

The fiscal 2016 financial statements of nike inc. shows average net operating assets (noa) of $8,450 million, average net nonoperating obligations (nno) of $(4,033) million, average total liabilities of $9,014 million, and average equity of $12,483 million. the company's 2016 financial leverage (flev) is: select one: a. (0.477) b. (0.559 c. (0.323) d. (0.447) e. there is not enough information to determine the ratio.

Answers: 2

Business, 22.06.2019 14:30

You hear your supervisor tell another supervisor that a fire drill will take place later today when the fire alarm sounds that afternoon you should

Answers: 1

Business, 22.06.2019 15:20

Gulliver travel agencies thinks interest rates in europe are low. the firm borrows euros at 5 percent for one year. during this time period the dollar falls 11 percent against the euro. what is the effective interest rate on the loan for one year? (consider the 11 percent fall in the value of the dollar as well as the interest payment.)

Answers: 2

Business, 22.06.2019 16:40

Determine the hrm’s role in the performance management process and explain how to ensure the process aligns with the organization’s strategic plan.

Answers: 1

You know the right answer?

An investor is considering a project that will generate $900,000 per year for four years. in additio...

Questions

Mathematics, 15.12.2021 18:30

Mathematics, 15.12.2021 18:30

English, 15.12.2021 18:30

Mathematics, 15.12.2021 18:30

Chemistry, 15.12.2021 18:30

History, 15.12.2021 18:30

Mathematics, 15.12.2021 18:30

Mathematics, 15.12.2021 18:30

English, 15.12.2021 18:30

Geography, 15.12.2021 18:30