Business, 24.12.2019 19:31 thegoat3180

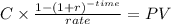

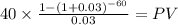

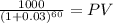

Acompany has an 8% bond that has a face value of $1,000 and matures in 30 years. assume that coupon payments are made semi-annually. the bonds are callable after 15 years at 108% of par value. what is the value of the bond if rates drop immediately to 6%? a. $1,277b. $2,192c. $1,452d. $1,229e. $602

Answers: 3

Another question on Business

Business, 22.06.2019 07:10

In a team environment, a coordinator is? a person with expert knowledge or skills in a particular area the team needs. a good listener who works to resolve social problems among teammates. a leader who team members focus on their tasks. a good networker who likes to explore new ideas and possiblities.

Answers: 2

Business, 22.06.2019 08:40

Calculate the cost of each capital component—in other words, the after-tax cost of debt, the cost of preferred stock (including flotation costs), and the cost of equity (ignoring flotation costs). use both the capm method and the dividend growth approach to find the cost of equity.calculate the cost of new stock using the dividend growth approach.what is the cost of new common stock based on the capm? (hint: find the difference between re and rs as determined by the dividend growth approach and then add that difference to the capm value for rs.)assuming that gao will not issue new equity and will continue to use the same target capital structure, what is the company’s wacc? e. suppose gao is evaluating three projects with the following characteristics.each project has a cost of $1 million. they will all be financed using the target mix of long-term debt, preferred stock, and common equity. the cost of the common equity for each project should be based on the beta estimated for the project. all equity will come from reinvested earnings.equity invested in project a would have a beta of 0.5 and an expected return of 9.0%.equity invested in project b would have a beta of 1.0 and an expected return of 10.0%.equity invested in project c would have a beta of 2.0 and an expected return of 11.0%.analyze the company’s situation, and explain why each project should be accepted or rejected g

Answers: 1

Business, 22.06.2019 10:30

Which analyst position analyzes information using mathematical models to business managers make decisions? -budget analyst -management analyst -credit analyst -operations research analyst

Answers: 1

Business, 22.06.2019 14:40

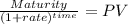

You are purchasing a bond that currently sold for $985.63. it has the time-to-maturity of 10 years and a coupon rate of 6%, paid semi-annually. the bond can be called for $1,020 in 3 years. what is the yield to maturity of this bond?

Answers: 2

You know the right answer?

Acompany has an 8% bond that has a face value of $1,000 and matures in 30 years. assume that coupon...

Questions

Mathematics, 08.05.2021 01:00

English, 08.05.2021 01:00

Physics, 08.05.2021 01:00

History, 08.05.2021 01:00

Mathematics, 08.05.2021 01:00

Mathematics, 08.05.2021 01:00

Mathematics, 08.05.2021 01:00

Mathematics, 08.05.2021 01:00

Mathematics, 08.05.2021 01:00

Mathematics, 08.05.2021 01:00

Mathematics, 08.05.2021 01:00