The yurdone corporation wants to set up a private cemetery business. according to the cfo, barry m. deep, business is "looking up". as a result, the cemetery project will provide a net cash inflow of $101,000 for the firm during the first year, and the cash flows are projected to grow at a rate of 3 percent per year forever. the project requires an initial investment of $1,540,000.

a-1

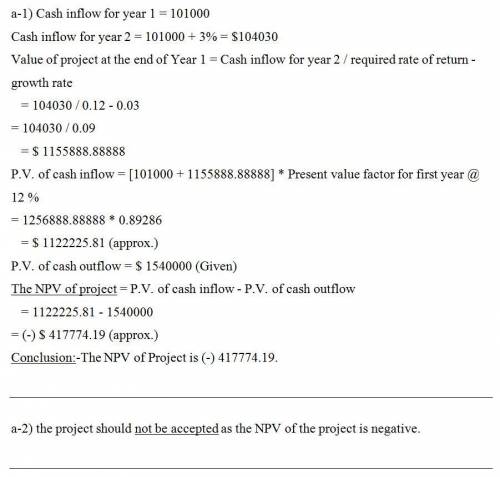

what is the npv for the project if yurdone's required return is 12 percent? (negative amount should be indicated by a minus sign. do not round intermediate calculations and round your final answer to 2 decimal places. (e. g., 32.16))

npv $

a-2

if yurdone requires a return of 12 percent on such undertakings, should the firm accept or reject the project?

reject

accept

b.

the company is somewhat unsure about the assumption of a 3 percent growth rate in its cash flows. at what constant growth rate would the company just break even if it still required a return of 12 percent on investment? (round your answer to 2 decimal places. (e. g., 32.16))

constant growth rate %

Answers: 2

Another question on Business

Business, 22.06.2019 12:10

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

Business, 23.06.2019 03:00

Madeline quits her job, at which she was earning $20,000 per year. she then takes $50,000 out of savings, on which she was earning 10% interest, and uses it to buy supplies for her business. she also pays $10,000 in rent on the building and $15,000 in additional labor costs. in her first year of operations, madeline receives $150,000 in revenue from sales. instructions: round each answer to a whole number. madeline's accounting cost is

Answers: 1

Business, 23.06.2019 10:10

Swain company manufactures one product, it does not maintain any beginning or ending inventories, and its uses a standard cost system. the company's beginning balance in retained earnings is $65,000. it sells one product for $170 per unit and it generated total sales during the period of $603,500 while incurring selling and administrative expenses of $54,500. swain company does not have any variable manufacturing overhead costs and its standard cost card for its only product is as follows:

Answers: 1

Business, 23.06.2019 17:20

Spartan systems reported total sales of $500,000, at a price of $20 and per unit variable expenses of $13, for the sales of their single product. total per unit sales $500,000 $20 variable expenses 325,000 13 contribution margin 175,000 $7 fixed expenses 120,000 net operating income $55,000 what is the amount of contribution margin if sales volume increases by 30%?

Answers: 1

You know the right answer?

The yurdone corporation wants to set up a private cemetery business. according to the cfo, barry m....

Questions

Physics, 07.12.2021 21:40

Mathematics, 07.12.2021 21:40

Social Studies, 07.12.2021 21:40

Computers and Technology, 07.12.2021 21:40

Mathematics, 07.12.2021 21:40

English, 07.12.2021 21:40

History, 07.12.2021 21:40

English, 07.12.2021 21:40

Physics, 07.12.2021 21:40

Chemistry, 07.12.2021 21:40

Physics, 07.12.2021 21:40

Physics, 07.12.2021 21:40