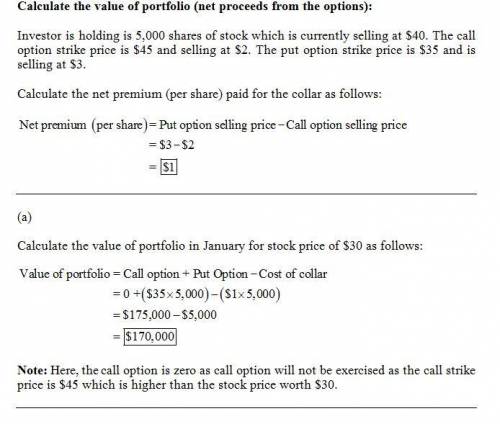

Imagine that you are holding 5,000 shares of stock, currently selling at $40 per share. you are ready to sell the shares but would prefer to put off the sale until next year for tax reasons. if you continue to hold the shares until january, however, you face the risk that the stock will drop in value before year end. you decide to use a collar to limit downside risk without laying out a good deal of additional funds. january call options with a strike of $45 are selling at $2, and january puts with a strike price of $35 are selling at $3. assume that you hedge the entire 5,000 shares of stock.

(a)

what will be the value of your portfolio in january (net of the proceeds from the options) if the stock price ends up at $30. (omit the "$" sign in your response.)

stock price $

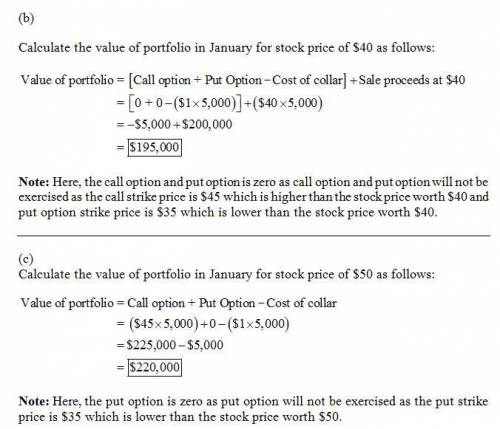

(b)

what will be the value of your portfolio in january (net of the proceeds from the options) if the stock price ends up at $40? (omit the "$" sign in your response.)

stock price $

(c)

what will be the value of your portfolio in january (net of the proceeds from the options) if the stock price ends up at $50? (omit the "$" sign in your response.)

stock price $

Answers: 3

Another question on Business

Business, 21.06.2019 14:40

Lohn corporation is expected to pay the following dividends over the next four years: $18, $14, $13, and $8.50. afterward, the company pledges to maintain a constant 4 percent growth rate in dividends forever. if the required return on the stock is 14 percent, what is the current share price?

Answers: 2

Business, 22.06.2019 17:40

Turrubiates corporation makes a product that uses a material with the following standards standard quantity 8.0 liters per unit standard price $2.50 per liter standard cost $20.00 per unit the company budgeted for production of 3,800 units in april, but actual production was 3,900 units. the company used 32,000 liters of direct material to produce this output. the company purchased 20,100 liters of the direct material at $2.6 per liter. the direct materials purchases variance is computed when the materials are purchased. the materials quantity variance for april is:

Answers: 1

Business, 22.06.2019 19:40

Chang corp. has $375,000 of assets, and it uses only common equity capital (zero debt). its sales for the last year were $595,000, and its net income was $25,000. stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 15.0%. what profit margin would the firm need in order to achieve the 15% roe, holding everything else constant? a. 9.45%b. 9.93%c. 10.42%d. 10.94%e. 11.49%

Answers: 2

Business, 22.06.2019 21:30

Zara, a global retail and apparel manufacturer based in spain that has successfully implemented this idea by having a continuous flow of new products that are typically limited in supply. zara has created a system that draws its clientèle into its stores, on average, 17 times per year as compared to 4 times per year for most stores. how is zara using it to gain competitive advantage? what specific technologies are used by zara to maintain this advantage over its competition?

Answers: 3

You know the right answer?

Imagine that you are holding 5,000 shares of stock, currently selling at $40 per share. you are read...

Questions

Mathematics, 20.05.2021 07:10

Mathematics, 20.05.2021 07:10

Mathematics, 20.05.2021 07:10

Mathematics, 20.05.2021 07:10

English, 20.05.2021 07:10

Mathematics, 20.05.2021 07:10

English, 20.05.2021 07:10

History, 20.05.2021 07:10

Medicine, 20.05.2021 07:10

Mathematics, 20.05.2021 07:10

Mathematics, 20.05.2021 07:10

Computers and Technology, 20.05.2021 07:10

Spanish, 20.05.2021 07:10

Mathematics, 20.05.2021 07:10