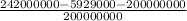

Consider a hedge fund with $200 million at the start of the year. the benchmark s& p 500 index was up 16.5% during the same period. the gross return on assets is 21%, and the expense ratio is 2%. for each 1% above the benchmark return, the fund managers receive a .1% incentive bonus. what was the annual return on this fund?

Answers: 1

Another question on Business

Business, 22.06.2019 03:30

Lindon company is the exclusive distributor for an automotive product that sells for $30.00 per unit and has a cm ratio of 30%. the company’s fixed expenses are $162,000 per year. the company plans to sell 20,200 units this year. required: 1. what are the variable expenses per unit? (round your "per unit" answer to 2 decimal places.) 2. what is the break-even point in unit sales and in dollar sales? 3. what amount of unit sales and dollar sales is required to attain a target profit of $72,000 per year? 4. assume that by using a more efficient shipper, the company is able to reduce its variable expenses by $3.00 per unit. what is the company’s new break-even point in unit sales and in dollar sales? what dollar sales is required to attain a target profit of $72,000?

Answers: 2

Business, 22.06.2019 16:40

Shawn received an e-mail offering a great deal on music, movie, and game downloads. he has never heard of the company, and the e-mail address and company name do not match. what should shawn do?

Answers: 2

Business, 22.06.2019 20:00

Question 6 of 102 pointswhich situation shows a constant rate of change? oa. the number of tickets sold compared with the number of minutesbefore a football gameob. the height of a bird over timeoc. the cost of a bunch of grapes compared with its weightod. the outside temperature compared with the time of day

Answers: 1

Business, 22.06.2019 21:30

Consider the following three bond quotes; a treasury note quoted at 87.25, and a corporate bond quoted at 102.42, and a municipal bond quoted at 101.45. if the treasury and corporate bonds have a par value of $1,000 and the municipal bond has a par value of $5,000, what is the price of these three bonds in dollars? multiple choice $872.50, $1,000, $1,000, respectively $1,000, $1,024.20, $1,001.45, respectively $872.50, $1,024.20, $5,072.50, respectively $1,000, $1,000, $1,000, respectively

Answers: 3

You know the right answer?

Consider a hedge fund with $200 million at the start of the year. the benchmark s& p 500 index w...

Questions

Mathematics, 30.10.2020 23:50

Mathematics, 30.10.2020 23:50

Mathematics, 30.10.2020 23:50

English, 30.10.2020 23:50

Health, 30.10.2020 23:50

History, 30.10.2020 23:50

Mathematics, 30.10.2020 23:50

Mathematics, 30.10.2020 23:50

Chemistry, 30.10.2020 23:50

Mathematics, 30.10.2020 23:50