Business, 26.12.2019 03:31 lilspike420

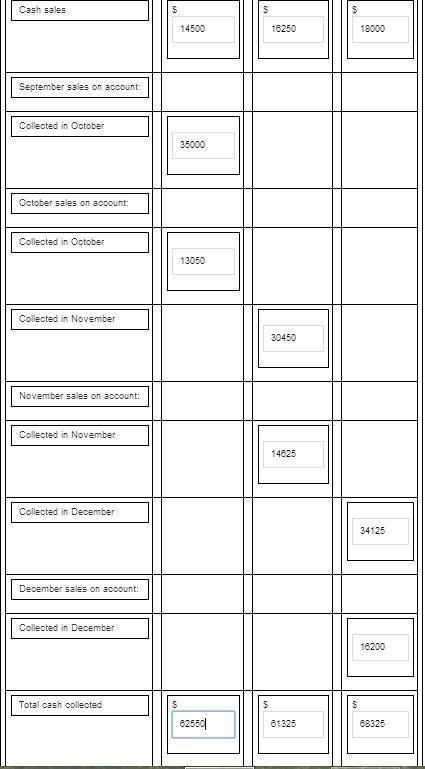

Officemart inc. has "cash and carry" customers and credit customers. officemart estimates that 25% of monthly sales are to cash customers, while the remaining sales are to credit customers. of the credit customers, 30% pay their accounts in the month of sale, while the remaining 70% pay their accounts in the month following the month of sale. projected sales for the next three months are as follows: october $58,000 november 65,000 december 72,000 the accounts receivable balance on september 30 was $35,000. prepare a schedule of cash collections from sales for october, november, and december.

Answers: 1

Another question on Business

Business, 21.06.2019 21:00

Management discovers that a supervisor at one of its restaurant locations removes excess cash and resets sales totals throughout the day on the point-of-sale (pos) system. at closing, the supervisor deposits cash equal to the recorded sales on the pos system and keeps the rest.the supervisor forwards the close-of-day pos reports from the pos system along with a copy of the bank deposit slip to the company’s revenue accounting department. the revenue accounting department records the sales and the cash for the location in the general ledger and verifies the deposit slip to the bank statement. any differences between sales and deposits are recorded in an over/short account and, if necessary, followed up with the location supervisor. the customer food order checks are serially numbered, and it is the supervisor’s responsibility to see that they are accounted for at the end of each day. customerchecks and the transaction journal tapes from the pos system are kept by the supervisor for 1 week at the location and then destroyed.what control allowed the fraud to occur?

Answers: 2

Business, 22.06.2019 03:00

Compare the sources of consumer credit 1. consumers use a prearranged loan using special checks 2. consumers use cards with no interest and non -revolving balances 3. consumers pay off debt and credit is automatically renewed 4. consumers take out a loan with a repayment date and have a specific purpose a. travel and entertainment credit b. revolving check credit c. closed-end credit d. revolving credit

Answers: 1

Business, 22.06.2019 14:30

What’s the present value of a perpetuity that pays $250 per year if the appropriate interest rate is 5%? $4,750 $5,000 $5,250 $5,513 $5,788what is the present value of the following cash flow stream at a rate of 8.0%, rounded to the nearest dollar? cash flows: today (t = 0) it is $750, after one year (t = 1) it is $2,450, at t = 2 it is $3,175, and at t=3 it is $4,400. draw a time line. $7,917 $8,333 $8,772 $9,233 $9,695

Answers: 2

Business, 22.06.2019 20:00

Ryngard corp's sales last year were $38,000, and its total assets were $16,000. what was its total assets turnover ratio (tato)? a. 2.04b. 2.14c. 2.26d. 2.38e. 2.49

Answers: 1

You know the right answer?

Officemart inc. has "cash and carry" customers and credit customers. officemart estimates that 25% o...

Questions

Business, 22.09.2020 08:01

Mathematics, 22.09.2020 08:01

Social Studies, 22.09.2020 08:01

Geography, 22.09.2020 08:01

Engineering, 22.09.2020 08:01

Mathematics, 22.09.2020 08:01

Mathematics, 22.09.2020 08:01

Mathematics, 22.09.2020 08:01

Mathematics, 22.09.2020 08:01

Arts, 22.09.2020 08:01

Biology, 22.09.2020 08:01