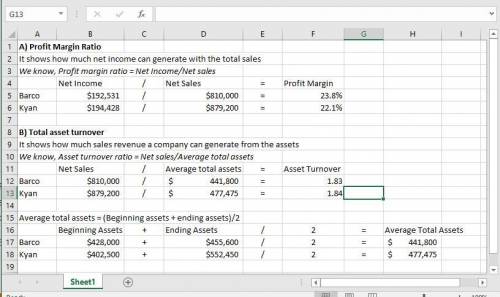

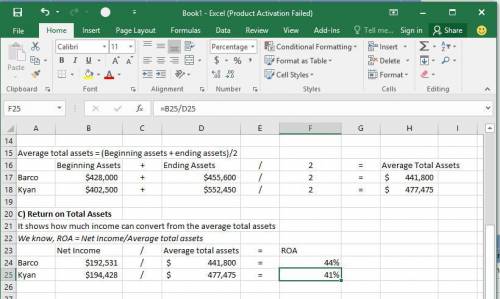

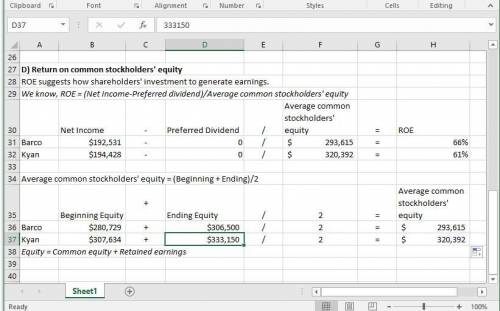

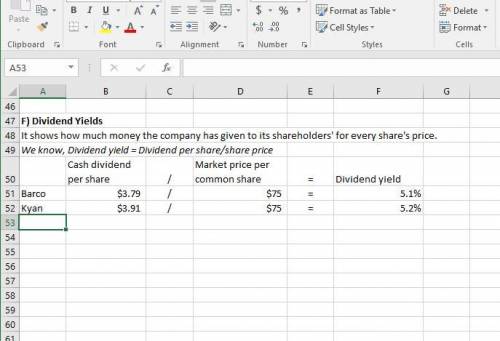

For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on total assets, and (d) return on common stockholders’ equity. assuming that each company’s stock can be purchased at $75 per share, compute their (e) price-earnings ratios and (f) dividend yields. (do not round intermediate calculations. round your answers to 2 decimal places.) 2b. identify which company’s stock you would recommend as the better investment. summary information from the financial statements of two companies competing in the same industry follows barco kyan barco kyan company company company company 879,200 646,500 data from the current year-end balance sheets data from the current year's income statement assets sales $ 810,000 $ $ 36,000 $ 18,500 36,400 593,100 8,800 15,569 cash cost of goods sold 53,400 interest expense accounts receivable, net current notes receivable (trade) merchandise inventory prepaid expenses plant assets, net 14,000 24,272 192,53 194,428 4.50 3.91 10,000 income tax expense 7,200 84,940 138,500 net income 5,800 6,950basic earnings per share cash dividends per share 4.38 3.79 300,000 310,400 552,450 total assets $455,640 $ beginning-of-year balance sheet data accounts receivable, net liabilities and equity current liabilities long-term notes payable $ 28,800 $ 51,200 0 59,600 105,400 $ 67,340 $102,300 current notes receivable (trade) 0 81,800 117,000merchandise inventory 402,500 428,000 common stock, $5 par value retained earnings 220,000 216,000 total assets 117,150 552,450 86,500 common stock, $5 par value 220,000 216,000 total liabilities and equity $455,640 $ retained earnings 60,729 91,634

Answers: 1

Another question on Business

Business, 22.06.2019 00:10

What are the forecasted levels of the line of credit and special dividends? (hints: create a column showing the ratios for the current year; then create a new column showing the ratios used in the forecast. also, create a preliminary forecast that doesn’t include any new line of credit or special dividends. identify the financing deficit or surplus in this preliminary forecast and then add a new column that shows the final forecast that includes any new line of credit or special dividend.) now assume that the growth in sales is only 3%. what are the forecasted levels of the line of credit and special dividends?

Answers: 1

Business, 22.06.2019 23:10

Asemiprofessional baseball team near your town plays two home games each month at the local baseball park. they split the concessions 50/50 with the city, but keep revenue from ticket sales for themselves. the city charges the team $100 each month for the three-month season. the team pays the players and manager a total of $1,000 a month. the team charges $10 for each ticket, and the average customer spends $7 at the concession stand. attendance averages 30 people at each home game.in order to break even, how many tickets does the team need to sell for each game? a. 33b. 37c. 41e. 49f. 244

Answers: 1

Business, 23.06.2019 02:30

Organizations typically rely on schedules, such as hourly wages and annual reviews and raises.

Answers: 2

Business, 23.06.2019 05:20

What is difference between fiscal year and tax year? explain in the simplest way.

Answers: 1

You know the right answer?

For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on tota...

Questions

Mathematics, 28.03.2021 20:40

History, 28.03.2021 20:40

Social Studies, 28.03.2021 20:40

Social Studies, 28.03.2021 20:40

Physics, 28.03.2021 20:40

Mathematics, 28.03.2021 20:40

Mathematics, 28.03.2021 20:50

Social Studies, 28.03.2021 20:50

Mathematics, 28.03.2021 20:50

Mathematics, 28.03.2021 20:50

Arts, 28.03.2021 20:50

Biology, 28.03.2021 20:50