Business, 31.12.2019 07:31 capricorn0115

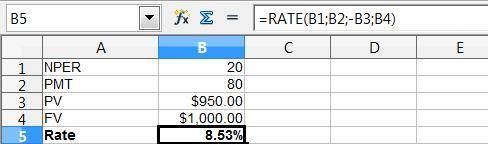

Jbl has a 20-year, 8% annual coupon bonds outstanding. if the bonds currently sell for 95% of $1000 par value and the firm pays an average tax rate of 35%, what will be the before-tax and after-tax component cost of debt?

Answers: 3

Another question on Business

Business, 22.06.2019 00:00

Ok, so, theoretical question: if i bought the mona lisa legally, would anyone be able to stop me from eating it? why or why not?

Answers: 1

Business, 22.06.2019 01:40

Select the word from the list that best fits the definition sometimes

Answers: 2

Business, 22.06.2019 02:30

Acompany factory is considered which type of resource a.land b.physical capital c.labor d.human capital

Answers: 2

Business, 22.06.2019 20:00

If a government accumulates chronic budget deficits over time, what's one possible result? a. a collective action problem b. a debt crisis c. regulatory capture d. an unfunded liability

Answers: 2

You know the right answer?

Jbl has a 20-year, 8% annual coupon bonds outstanding. if the bonds currently sell for 95% of $1000...

Questions

Business, 28.09.2019 17:20

Chemistry, 28.09.2019 17:20

Health, 28.09.2019 17:20

Mathematics, 28.09.2019 17:20

Geography, 28.09.2019 17:20

Social Studies, 28.09.2019 17:20

Social Studies, 28.09.2019 17:20