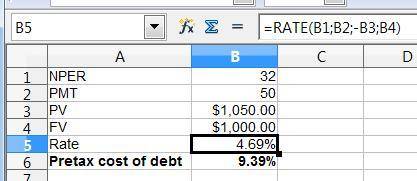

Advance, inc., is trying to determine its cost of debt. the firm has a debt issue outstanding with 16 years to maturity that is quoted at 105 percent of face value. the issue makes semiannual payments and has a coupon rate of 10 percent annually. required: (a) what is advance's pretax cost of debt? (do not include the percent sign round your answer to 2 decimal places. (e. g., 32.16) pretax cost of debt (b) if the tax rate is 35 percent, what is the aftertax cost of debt? (do not include the percent sign round your answer to 2 decimal places. (e. g., 32.16) aftertax cost of debt

Answers: 2

Another question on Business

Business, 22.06.2019 09:40

Salt corporation's contribution margin ratio is 78% and its fixed monthly expenses are $30,000. assume that the company's sales for may are expected to be $89,000. required: estimate the company's net operating income for may, assuming that the fixed monthly expenses do not change.

Answers: 1

Business, 22.06.2019 11:40

If kroger had whole foods’ number of days’ sales in inventory, how much additional cash flow would have been generated from the smaller inventory relative to its actual average inventory position? round interim calculations to one decimal place and your final answer to the nearest million.

Answers: 2

Business, 22.06.2019 16:40

Determine the hrm’s role in the performance management process and explain how to ensure the process aligns with the organization’s strategic plan.

Answers: 1

Business, 22.06.2019 22:10

Asupermarket has been experiencing long lines during peak periods of the day. the problem is noticeably worse on certain days of the week, and the peak periods are sometimes different according to the day of the week. there are usually enough workers on the job to open all cash registers. the problem is knowing when to call some of the workers stocking shelves up to the front to work the checkout counters. how might decision models the supermarket? what data would be needed to develop these models?

Answers: 2

You know the right answer?

Advance, inc., is trying to determine its cost of debt. the firm has a debt issue outstanding with 1...

Questions

History, 03.06.2021 18:50

English, 03.06.2021 18:50

English, 03.06.2021 18:50

Geography, 03.06.2021 18:50

Mathematics, 03.06.2021 18:50

Mathematics, 03.06.2021 18:50

Mathematics, 03.06.2021 18:50

History, 03.06.2021 18:50

Mathematics, 03.06.2021 18:50

English, 03.06.2021 18:50

Mathematics, 03.06.2021 18:50

Mathematics, 03.06.2021 18:50