Business, 08.01.2020 00:31 ximenareyna07

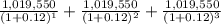

Quad enterprises is considering a new three year expansion project that requires an initial fixed asset investment of 2.32 million. the fixed asset will be depreciated straight line to zero over its three year tax life, after which time it will be worthless. the project estimated to generate 1.735 million in annual sales, with costs of 650,000. the tax rate is 21 percent and the required return on the project is 12 percent. what is the project's npv?

Answers: 1

Another question on Business

Business, 21.06.2019 17:10

Show the changes to the t-accounts for the federal reserve and for commercial banks when the federal reserve buys $50 million in u.s. treasury bills. if the public holds a fixed amount of currency (so that all loans create an equal amount of deposits in the banking system), the minimum reserve ratio is 10%, and banks hold no excess reserves, by how much will deposits in the commercial banks change? by how much will the money supply change? show the final changes to the t-account for commercial banks when the money supply changes by this amount.

Answers: 3

Business, 22.06.2019 03:00

In the supply-and-demand schedule shown above, at the lowest price of $50, producers supply music players and consumers demand music players.

Answers: 2

Business, 22.06.2019 09:30

Which are the best examples of costs that should be considered when creating a project budget?

Answers: 2

Business, 22.06.2019 19:00

All of the following led to the collapse of the soviet economy except a. a lack of worker incentives. c. inadequate supply of consumer goods. b. a reliance on production quotas. d. the introduction of a market economy.

Answers: 1

You know the right answer?

Quad enterprises is considering a new three year expansion project that requires an initial fixed as...

Questions

Social Studies, 06.07.2019 22:00

English, 06.07.2019 22:00

Mathematics, 06.07.2019 22:00

History, 06.07.2019 22:00

Mathematics, 06.07.2019 22:00

Mathematics, 06.07.2019 22:00

Biology, 06.07.2019 22:00

History, 06.07.2019 22:00

Mathematics, 06.07.2019 22:00

History, 06.07.2019 22:00

Mathematics, 06.07.2019 22:00

English, 06.07.2019 22:00

- 2,320,000

- 2,320,000