Business, 08.01.2020 00:31 sashamanger2396

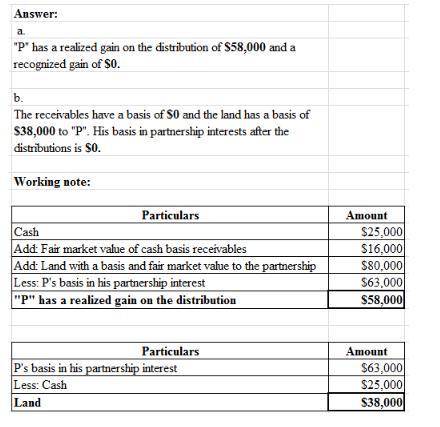

Pablo has a $63,000 basis in his partnership interest. on may 9 of the current tax year, the partnership distributes to him, in a proportionate current distribution, cash of $25,000, cash basis receivables with an inside basis of $0 and a fair market value of $16,000, and land with a basis and fair market value to the partnership of $80,000.

how much is pablo’s realized and recognized gain on the distribution?

Answers: 1

Another question on Business

Business, 22.06.2019 10:30

What are the positive environmental trends seen today? many industries are taking measures to reduce the use( _gold,carbon dioxide,ozone_) of -depleting substances and are turning to(_scarce,renewable,non-recyclable_) energy sources though they may seem expensive. choose one of those 3 option to fill the

Answers: 3

Business, 22.06.2019 12:10

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

Business, 22.06.2019 15:20

Capital financial corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. the current prime rate is 16.50 percent, and capital charges 3.50 percent over prime to charming as its annual loan rate. a. determine the maximum loan for which charming paper company could qualify.

Answers: 1

You know the right answer?

Pablo has a $63,000 basis in his partnership interest. on may 9 of the current tax year, the partner...

Questions

Biology, 21.08.2019 22:40

Mathematics, 21.08.2019 22:40

Mathematics, 21.08.2019 22:40

Mathematics, 21.08.2019 22:40

History, 21.08.2019 22:40

Social Studies, 21.08.2019 22:40

Chemistry, 21.08.2019 22:40

Mathematics, 21.08.2019 22:40

Physics, 21.08.2019 22:40

Mathematics, 21.08.2019 22:40