Business, 08.01.2020 01:31 robertotugalanp1wlgs

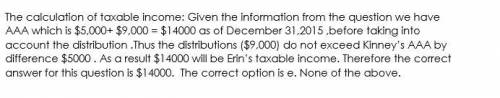

On january 1, 2015, kinney, inc., an electing s corporation, holds $5,000 of aep and $9,000 in aaa. kinney has two shareholders, eric and maria, each of whom owns 500 shares of kinney's stock. kinney's 2015 taxable income is $6,000. kinney distributes $6,000 to each shareholder on february 1 2015, and distributes another $3,000 to each shareholder shareholder on september 1.

how is erin taxed on the distribution?

a. $500 dividend income.

b. $1,000 dividend income.

c. $1,500 dividend income.

d. $3,000 dividend income.

e. none of the above.

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

Andrew cooper decides to become a part owner of a corporation. as a part owner, he expects to receive a profit as payment because he has assumed the risk of - serious inflation eroding the purchasing power of his investment.- being paid before the suppliers and employees are paid.- losing his home, car, and life savings.- losing the money he has invested in the corporation and not receiving profits.- the company giving all of the profits to local communities

Answers: 2

Business, 22.06.2019 10:10

conquest, inc. produces a special kind of light-weight, recreational vehicle that has a unique design. it allows the company to follow a cost-plus pricing strategy. it has $9,000,000 of average assets, and the desired profit is a 10% return on assets. assume all products produced are sold. additional data are as follows: sales volume 1000 units per year; variable costs $1000 per unit; fixed costs $4,000,000 per year; using the cost-plus pricing approach, what should be the sales price per unit?

Answers: 2

Business, 22.06.2019 20:20

John has served as the chief operating officer (coo) for business graphics, inc., a publicly owned firm, the past 5 years. which of the following statements about john is correct? both john and the ceo of business graphics must certify to the sec that the firm's financial statements are accurate. as the coo, john will be ranked higher than the ceo but still below the cfo. in john's postition as the coo, it is highly unlikely that he would also be the chairperson of the board of directors. as the coo, john would typically be involved with accounting, finance, and asset purchase decisions.

Answers: 2

Business, 22.06.2019 22:40

The uptowner just paid an annual dividend of $4.12. the company has a policy of increasing the dividend by 2.5 percent annually. you would like to purchase shares of stock in this firm but realize that you will not have the funds to do so for another four years. if you require a rate of return of 16.7 percent, how much will you be willing to pay per share when you can afford to make this investment?

Answers: 2

You know the right answer?

On january 1, 2015, kinney, inc., an electing s corporation, holds $5,000 of aep and $9,000 in aaa....

Questions

English, 11.07.2019 07:00

Geography, 11.07.2019 07:00

Geography, 11.07.2019 07:00

Computers and Technology, 11.07.2019 07:00

Mathematics, 11.07.2019 07:00

Spanish, 11.07.2019 07:00

Mathematics, 11.07.2019 07:00

Social Studies, 11.07.2019 07:00

History, 11.07.2019 07:00

History, 11.07.2019 07:00

History, 11.07.2019 07:00

History, 11.07.2019 07:00