Business, 08.01.2020 06:31 natasniebow

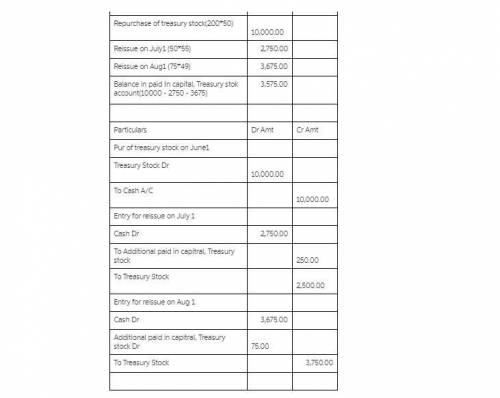

1- prior to june 1, a company has never had any treasury stock transactions. a company repurchased 200 shares of its $10 par common stock on june 1 for $50 per share on july 1, it reissued 50 of these shares at $55 per share. what is the credit to paid in capital, treasury stock required to record this event? 2- prior to june 1, a company has never had any treasury stock transactions. a company repurchased 200 shares of its $10 par common stock on june 1 for $50 per share on july 1, it reissued 50 of these shares at $55 per share. on august 1, it reissued 75 treasury shares at $49 per share. what is the balance in the paid-in capital, treasury stock account on august 2 after all of the events in this and the last two questions are recorded?

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

Monetary policy in the united states is carried out primarily by which of the following agencies? a. the department of the treasury b. the small business association c. the federal reserve bank d. the u.s. mint 2b2t

Answers: 1

Business, 22.06.2019 01:30

Iam trying to get more members on my blog. how do i do this?

Answers: 3

Business, 22.06.2019 12:10

In year 1, the bennetts' 25-year-old daughter, jane, is a full-time student at an out-of-state university but she plans to return home after the school year ends. in previous years, jane has never worked and her parents have always been able to claim her as a dependent. in year 1, a kind neighbor offers to pay for all of jane's educational and living expenses. which of the following statements is most accurate regarding whether jane's parents would be allowed to claim an exemption for jane in year 1 assuming the neighbor pays for all of jane's support? a.no, jane must include her neighbor's gift as income and thus fails the gross income test for a qualifying relative.b.yes, because she is a full-time student and does not provide more than half of her own support, jane is considered her parent's qualifying child.c.no, jane is too old to be considered a qualifying child and fails the support test of a qualifying relative.d.yes, because she is a student, her absence is considered as "temporary." consequently she meets the residence test and is a considered a qualifying child of the bennetts.

Answers: 2

Business, 22.06.2019 13:50

The retained earnings account has a credit balance of $24,650 before closing entries are made. if total revenues for the period are $77,700, total expenses are $56,900, and dividends are $13,050, what is the ending balance in the retained earnings account after all closing entries are made?

Answers: 2

You know the right answer?

1- prior to june 1, a company has never had any treasury stock transactions. a company repurchased 2...

Questions

Social Studies, 19.05.2020 02:00

Mathematics, 19.05.2020 02:00

English, 19.05.2020 02:00

Mathematics, 19.05.2020 02:00

Mathematics, 19.05.2020 02:00

Mathematics, 19.05.2020 02:00

Mathematics, 19.05.2020 02:00

Computers and Technology, 19.05.2020 02:01