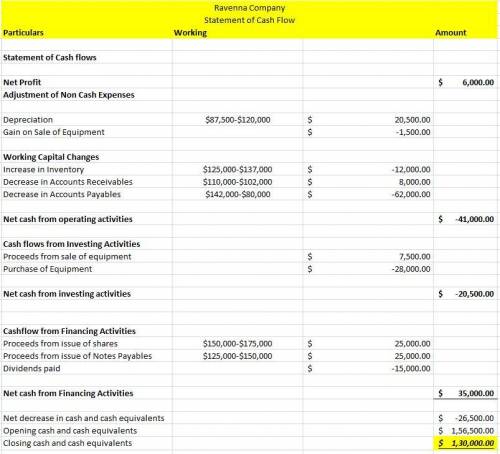

Ravenna company is a merchandiser that uses the indirect method to prepare the operating activities section of its statement of cash flows. its balance sheet for this year is as follows: ending balance beginning balance cash $130,000 $156,500 accounts receivable 102,000 110,000 inventory 137,000 125,000 total current assets 369,000 391,500 property, plant, and equipment 360,000 350,000 less accumulated depreciation 120,000 87,500 net property, plant, and equipment 240,000 262,500 total assets $609,000 $654,000 accounts payable $80,000 $142,000 income taxes payable 62,000 86,000 bonds payable 150,000 125,000 common stock 175,000 150,000 retained earnings 142,000 151,000 total liabilities and stockholders’ equity $609,000 $654,000 during the year, ravenna paid a $15,000 cash dividend and it sold a piece of equipment for $7,500 that had originally cost $18,000 and had accumulated depreciation of $12,000. the company did not retire any bonds or repurchase any of its own common stock during the year.

what is the amount of the net increase or decrease in cash and cash equivalents that would be shown on the company’s statement of cash flows?

Answers: 1

Another question on Business

Business, 22.06.2019 05:10

Responsible for setting the goals and planning for the future as well as leading and controlling the work of others. out the decisions of top management. often responsible for various departments such as the production, marketing, and accounting departments. process or function of planning organizing leading and controlling. the resources arranged in an orderly and functional way to accomplish goals and objectives. the company on track and making sure goals are met. for the daily operations of a business. examples of this are supervisors, office managers, and crew leaders. act or process of creating goals and objectives as well as the strategies to meet them. for the daily operations of a business. examples of this are supervisors, office managers, and crew leaders. how the firm is structured and who is in charge of whom. direction and vision

Answers: 3

Business, 22.06.2019 15:20

Martinez company has the following two temporary differences between its income tax expense and income taxes payable. 2017 2018 2019 pretax financial income $873,000 $866,000 $947,000 (2017' 2018, 2019) excess depreciation expense on tax return (29,400 ) (39,000 ) (9,600 ) (2017' 2018, 2019) excess warranty expense in financial income 20,000 9,900 8,300 (2017' 2018, 2019) taxable income $863,600 $836,900 $945,700(2017' 2018, 2019) the income tax rate for all years is 40%. instructions: a. prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017, 2018, and 2019. b. assuming there were no temporary differences prior to 2016, indicate how deferred taxes will be reported on the 2016 balance sheet. button's warranty is for 12 months. c. prepare the income tax expense section of the income statement for 2017, beginning with the line, "pretax financial income."

Answers: 3

Business, 22.06.2019 20:20

Carmen’s beauty salon has estimated monthly financing requirements for the next six months as follows: january $ 9,000 april $ 9,000 february 3,000 may 10,000 march 4,000 june 5,000 short-term financing will be utilized for the next six months. projected annual interest rates are: january 9 % april 16 % february 10 may 12 march 13 june 12 what long-term interest rate would represent a break-even point between using short-term financing and long-term financing?

Answers: 3

You know the right answer?

Ravenna company is a merchandiser that uses the indirect method to prepare the operating activities...

Questions

Mathematics, 17.07.2019 14:00

Mathematics, 17.07.2019 14:00

English, 17.07.2019 14:00

English, 17.07.2019 14:00

Mathematics, 17.07.2019 14:00

Mathematics, 17.07.2019 14:00

English, 17.07.2019 14:00

Mathematics, 17.07.2019 14:00

Social Studies, 17.07.2019 14:00

Mathematics, 17.07.2019 14:00

Mathematics, 17.07.2019 14:00

English, 17.07.2019 14:00