using the following data, answer the questions in below.

garcon company pepper company

...

using the following data, answer the questions in below.

garcon company pepper company

beginning finished goods inventory $12,000 $ 16,450

beginning raw materials inventory 14,500 19,950

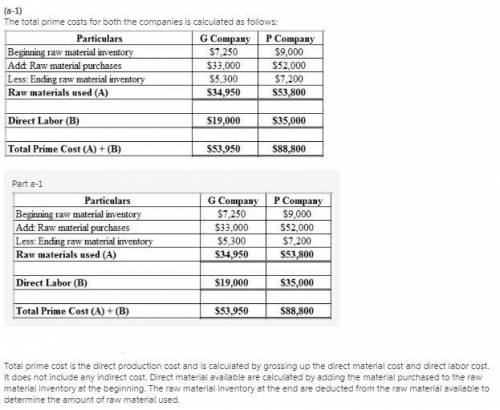

beginning raw materials inventory 7,250 9,000

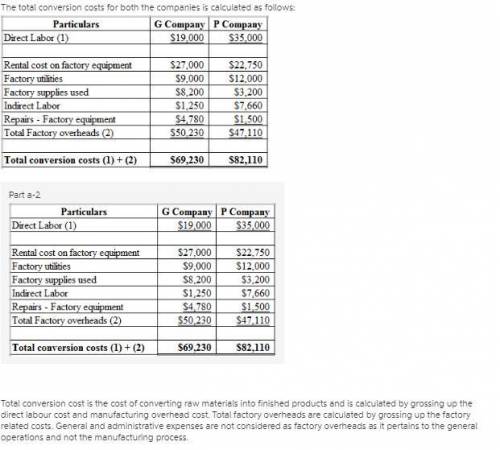

rental cost on factory equipment 27,000 22,750

direct labor 19,000 35,000

ending finished goods inventory 17,650 13,300

ending work in process inventory 22,000 16,000

ending raw materials inventory 5,300 7,200

factory utilities 9,000 12,000

factory supplies used 8,200 3,200

general and administrative expenses 21,000 43,000

indirect labor 1,250 7,660

raw materials purchases 4,780 1,500

selling expenses 33,000 52,000

sales 195,030 290,010

cash 20,000 15,700

factory equipment, net 212,500 115,825

accounts receivable, net 13,200 19,450

questions:

1. prepare income statements for both garcon company and pepper company.

2. prepare the current assets section of the balance sheet for each company.

Answers: 2

Another question on Business

Business, 21.06.2019 20:30

Which of the following best describes how the federal reserve bank banks during a bank run? a. the federal reserve bank regulates exchanges to prevent the demand for withdrawals from rising above the required reserve ratio. b. the federal reserve bank acts as an insurance company that pays customers if their bank fails. c. the federal reserve bank has the power to take over a private bank if customers demand too many withdrawals. d. the federal reserve bank can provide a short-term loan to banks to prevent them from running out of money. 2b2t

Answers: 2

Business, 21.06.2019 23:20

Which feature transfers a slide show into a word-processing document?

Answers: 2

Business, 22.06.2019 01:30

Ben collins plans to buy a house for $166,000. if the real estate in his area is expected to increase in value by 2 percent each year, what will its approximate value be five years from now?

Answers: 1

Business, 22.06.2019 04:00

Assume that the following conditions exist: a. all banks are fully loaned up- there are no excess reserves, and desired excess reserves are always zero. b. the money multiplier is 5 . c. the planned investment schedule is such that at a 4 percent rate of interest, investment =$1450 billion. at 5 percent, investment is $1420 billion. d. the investment multiplier is 3 . e.. the initial equilibrium level of real gdp is $12 trillion. f. the equilibrium rate of interest is 4 percent now the fed engages in contractionary monetary policy. it sells $1 billion worth of bonds, which reduces the money supply, which in turn raises the market rate of interest by 1 percentage point. calculate the decrease in money supply after fed's sale of bonds: $nothing billion.

Answers: 2

You know the right answer?

Questions

English, 16.10.2021 23:30

Mathematics, 16.10.2021 23:30

Mathematics, 16.10.2021 23:30

Mathematics, 16.10.2021 23:30

Mathematics, 16.10.2021 23:30

Spanish, 16.10.2021 23:30

Biology, 16.10.2021 23:30

Mathematics, 16.10.2021 23:30

Biology, 16.10.2021 23:40

English, 16.10.2021 23:40