Business, 15.01.2020 07:31 mayfieldashley2437

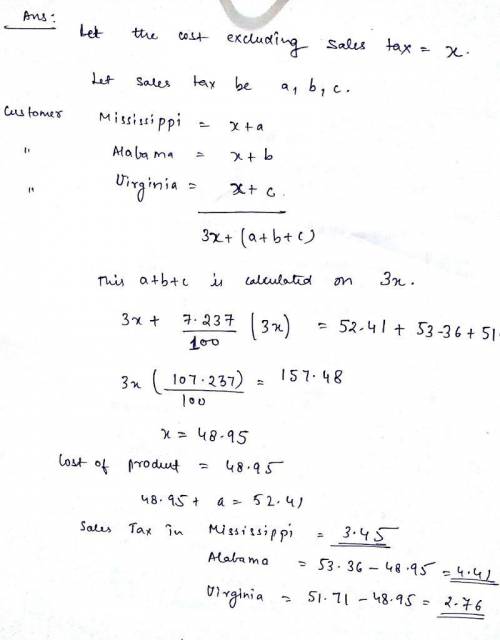

Problem 12-15 in mississippi, a customer pays $52.41 for a product (including ms state sales tax). in alabama, a customer pays $53.36 for the same product. in virginia, the customer pays $51.71 for the same product. in all three states, the sticker price (price before state sales tax is added) is the same. the average sales tax of the three states is 7.237%. determine the sales tax in each state and the cost of the product from the information given. express your answers in percent for sales tax and in dollars and cents for cost. (do not include the $ or % symbol in your answer online, only the final value with two decimal places.) (read the online version of this question carefully; it will ask for one of the values you found in a series of four questions.)

Answers: 2

Another question on Business

Business, 22.06.2019 00:00

Which statement about the cost of the options is true? she would save $1,000 by choosing option b. she would save $5,650 by choosing option a. she would save $11,200 by choosing option b. she would save $11,300 by choosing option a.

Answers: 2

Business, 22.06.2019 05:50

Nichols inc. manufactures remote controls. currently the company uses a plantminuswide rate for allocating manufacturing overhead. the plant manager is considering switchingminusover to abc costing system and has asked the accounting department to identify the primary production activities and their cost drivers which are as follows: activities cost driver allocation rate material handling number of parts $5 per part assembly labor hours $20 per hour inspection time at inspection station $10 per minute the current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $20 per labor hour. what are the indirect manufacturing costs per remote control assuming an method is used and a batch of 10 remote controls are produced? the batch requires 100 parts, 5 direct manufacturing labor hours, and 3 minutes of inspection time.

Answers: 2

Business, 22.06.2019 18:50

)a business incurs the following costs per unit: labor $125/unit, materials $45/unit, and rent $250,000/month. if the firm produces 1,000,000 units a month, calculate the following: a. total variable costs b. total fixed costs c. total costs

Answers: 1

Business, 22.06.2019 19:00

The demand curve determines equilibrium price in a market. is a graphical representation of the relationship between price and quantity demanded. depicts the relationship between production costs and output. is a graphical representation of the relationship between price and quantity supplied.

Answers: 1

You know the right answer?

Problem 12-15 in mississippi, a customer pays $52.41 for a product (including ms state sales tax). i...

Questions

Advanced Placement (AP), 09.10.2020 02:01

Mathematics, 09.10.2020 02:01

Chemistry, 09.10.2020 02:01

Mathematics, 09.10.2020 02:01

Mathematics, 09.10.2020 02:01

Geography, 09.10.2020 02:01

Mathematics, 09.10.2020 02:01

Biology, 09.10.2020 02:01

History, 09.10.2020 02:01

History, 09.10.2020 02:01

Mathematics, 09.10.2020 02:01