Inferring transactions from financial statements

costco wholesale corporation operates members...

Business, 15.01.2020 07:31 datboyjulio21

Inferring transactions from financial statements

costco wholesale corporation operates membership warehouses selling food, appliances, consumer electronics, apparel and other household goods at 582 locations across the u. s. as well as in canada, the united kingdom, japan, australia, south korea, taiwan, mexico and puerto rico. as of its fiscal year-end 2010, costco had approximately 60 million members. selected fiscal-year information from the company's balance sheets follows. ($ millions).

selected balance sheet data 2010 2009

merchandise inventories $5,638 $5,405

deferred membership income (liability) 869 824

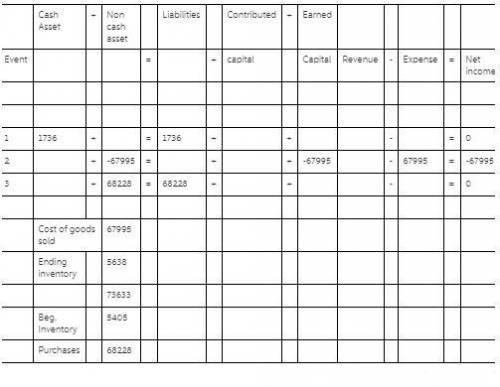

(a) during fiscal 2010, costco collected $1,736 cash for membership fees. use the financial statement effects template to record the cash collected for membership fees.

(b) in 2010, costco recorded $67,995 million in merchandise costs (that is, cost of goods sold). record this transaction in the financial statement effects template.

(c) determine the value of merchandise that costco purchased during fiscal-year 2010. use the financial statement effects template to record these merchandise purchases. assume all of costco's purchases are on credit.

balance sheet

transaction cash asset + noncash assets = liabilities + contributed capital + earned capital

(a)

(b)

(c)

income statement

revenue

-

expenses

=

net income

Answers: 1

Another question on Business

Business, 21.06.2019 14:30

Abc computer company has a $20 million factory in silicon valley in which in builds computer components. during the current year, abc's costs are labor (wages) of $1.01.0 million; interest on debt of $0.20.2 million; and taxes of $0.20.2 million. abc sells all its output to xyz supercomputer for $2.62.6 million. using abc's components, xyz builds four supercomputers at a cost of $0.8500.850 million each, which comes from $0.6500.650 million worth of components, $0.10.1 million in labor costs, and $0.10.1 million in taxes per computer. xyz has a $30 million factory. xyz sells three of the supercomputers to other businesses for $1.81.8 million each. at year's end, it had not sold the fourth. the unsold computer is carried on xyz's books as a $0.8500.850 million increase in inventory.

Answers: 1

Business, 21.06.2019 17:00

Herman is covered by a cafeteria plan by his employer. his adjusted gross income (agi) is $100,000. he paid unreimbursed medical premiums in the amount of $10,500 and he itemizes deductions. what amount will herman be able to deduct for his medical insurance premium expenses?

Answers: 1

Business, 22.06.2019 10:00

Frolic corporation has budgeted sales and production over the next quarter as follows. the company has 4100 units of product on hand at july 1. 10% of the next months sales in units should be on hand at the end of each month. october sales are expected to be 72000 units. budgeted sales for september would be: july august september sales in units 41,500 53,500 ? production in units 45,700 53,800 58,150

Answers: 3

Business, 22.06.2019 21:00

Noah met an old friend at a coffee shop. he jotted down the friend's new phone number, but later that afternoon he could not find it or remember what he had done with it. a couple of days later, noah went back to the coffee shop, and while waiting in line, he suddenly remembered where he had put the phone number. this is an example of:

Answers: 1

You know the right answer?

Questions

Mathematics, 17.05.2021 02:00

History, 17.05.2021 02:00

Mathematics, 17.05.2021 02:00

Biology, 17.05.2021 02:00

Mathematics, 17.05.2021 02:00

History, 17.05.2021 02:00

Chemistry, 17.05.2021 02:00

Chemistry, 17.05.2021 02:00

Mathematics, 17.05.2021 02:00