Business, 15.01.2020 19:31 kristieL50

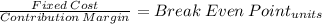

Requirement 3. suppose 250 comma 000 units are sold but only 50 comma 000 of them are deluxe. compute the operating income. compute the breakeven point in units. compare your answer with the answer to requirement 1. what is the major lesson of this problem? compute the operating income if 250 comma 000 units are sold but only 50 comma 000 of them are deluxe. standard carrier deluxe carrier total units sold 200,000 50,000 250,000 revenues at $28 and $50 per unit $5,600,000 $2,500,000 $8,100,000 variable costs at $18 and $30 per unit 3,600,000 1,500,000 5,100,000 contribution margin $2,000,000 $1,000,000 3,000,000 fixed costs 2,250,000 operating income $750,000 before calculating the breakeven points, determine the new sales mix. for every 1 deluxe carrier sold, 4 standard carriers are sold. compute the breakeven point in units, assuming the new sales mix. (round your answers up to the next whole number.) the breakeven point is 4 standard units and 1 deluxe units.

Answers: 3

Another question on Business

Business, 21.06.2019 23:00

James has set the goal of achieving all "a"s during this year of school.which term best describes this goal

Answers: 2

Business, 22.06.2019 11:00

Down under products, ltd., of australia has budgeted sales of its popular boomerang for the next four months as follows: unit salesapril 74,000may 85,000june 114,000july 92,000the company is now in the process of preparing a production budget for the second quarter. past experience has shown that end-of-month inventory levels must equal 10% of the following month’s unit sales. the inventory at the end of march was 7,400 units.required: prepare a production budget by month and in total, for the second quarter.

Answers: 3

Business, 22.06.2019 11:30

Mark knopf is an auditor who has been asked to provide an audit and financial statement certification for a company that is going public on the new york stock exchange. knopf wants to know his personal liability if the company provides him with inaccurate or false information. which of the following sources of law will him answer that question? a. the city ordinances where the company headquarters is located. b. the state constitution of the state where the company is incorporated. c. code of federal regulations. d. all of the above

Answers: 1

Business, 22.06.2019 14:40

Nell and kirby are in the process of negotiating their divorce agreement. what should be the tax consequences to nell and kirby if the following, considered individually, became part of the agreement? a. in consideration for her one-half interest in their personal residence, kirby will transfer to nell stock with a value of $200,000 and $50,000 of cash. kirby's cost of the stock was $150,000, and the value of the personal residence is $500,000. they purchased the residence three years ago for $300,000.nell's basis for the stock is $ xkirby's basis in the house is $ xb. nell will receive $1,000 per month for 120 months. if she dies before receiving all 120 payments, the remaining payments will be made to her estate.the payments (qualify, do not qualify) as alimony and are (included in, excluded from) nell's gross income as they are received.c. nell is to have custody of their 12-year-old son, bobby. she is to receive $1,200 per month until bobby (1) dies or (2) attains age 21 (whichever occurs first). after either of these events occurs, nell will receive only $300 per month for the remainder of her life.$ x per month is alimony that is (included in, excluded from) nell's gross income, and the remaining $ x per month is considered (child support, property settlement) and is (nontaxable, taxable) to nell.

Answers: 3

You know the right answer?

Requirement 3. suppose 250 comma 000 units are sold but only 50 comma 000 of them are deluxe. comput...

Questions

History, 30.01.2020 17:46

Mathematics, 30.01.2020 17:46

Mathematics, 30.01.2020 17:46

Biology, 30.01.2020 17:46

Computers and Technology, 30.01.2020 17:46

Physics, 30.01.2020 17:46

Mathematics, 30.01.2020 17:46

Mathematics, 30.01.2020 17:46

Mathematics, 30.01.2020 17:46

English, 30.01.2020 17:46