Business, 17.01.2020 19:31 ejhoff9713

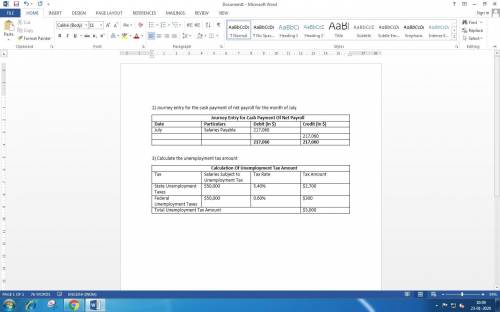

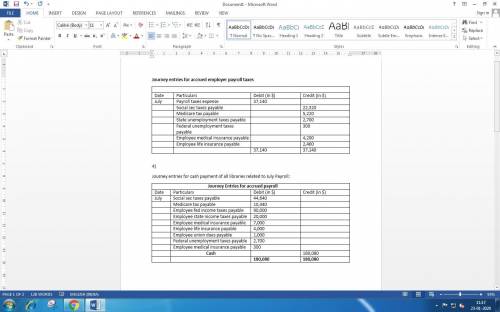

The following monthly data are taken from ramirez company at july 31:

sales salaries, $200,000

office salaries, $160,000

federal income taxes withheld, $90,000

state income taxes withheld, $20,000

social security taxes withheld, $22,320

medicare taxes withheld, $5,220

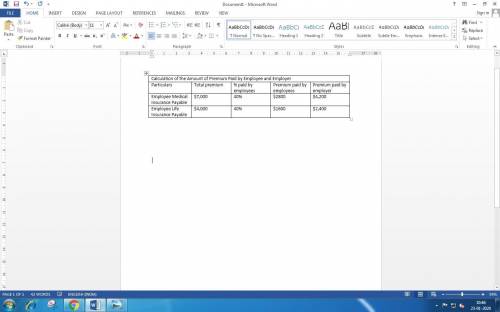

medical insurance premiums, $7,000

life insurance premiums, $4,000

union dues deducted, $1,000

salaries subject to unemployment taxes, $50,000

the employee pays 40% of medical and life insurance premiums. assume that fica taxes are identical to those on employees and that suta taxes are 5.4% and futa taxes are 0.6%.

prepare all journal entries.

Answers: 3

Another question on Business

Business, 22.06.2019 23:10

The direct labor budget of yuvwell corporation for the upcoming fiscal year contains the following details concerning budgeted direct labor-hours: 1st quarter 2nd quarter 3rd quarter 4th quarterbudgeted direct labor-hours 11,200 9,800 10,100 10,900the company uses direct labor-hours as its overhead allocation base. the variable portion of its predetermined manufacturing overhead rate is $6.00 per direct labor-hour and its total fixed manufacturing overhead is $80,000 per quarter. the only noncash item included in fixed manufacturing overhead is depreciation, which is $20,000 per quarter.required: 1. prepare the company’s manufacturing overhead budget for the upcoming fiscal year.2. compute the company’s predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year.

Answers: 3

Business, 23.06.2019 00:00

The undress company produces a dress that women use to quickly and easily change in public. the company is just over a year old and has been successful through a kickstarter campaign. the undress company has identified a customer segment, but if it wants to reach a larger customer segment market outside of the kickstarter family, what question must it answer?

Answers: 1

Business, 23.06.2019 02:40

Sean lives in dallas and runs a business that sells boats. in an average year, he receives $722,000 from selling boats. of this sales revenue, he must pay the manufacturer a wholesale cost of $422,000; he also pays wages and utility bills totaling $268,000. he owns his showroom; if he chooses to rent it out, he will receive $2,000 in rent per year. assume that the value of this showroom does not depreciate over the year. also, if sean does not operate this boat business, he can work as a paralegal, receive an annual salary of $21,000 with no additional monetary costs, and rent out his showroom at the $2,000 per year rate. no other costs are incurred in running this boat business.identify each of sean's costs in the following table as either an implicit cost or an explicit cost of selling boats.implicit costexplicit costthe wages and utility bills that sean pays the rental income sean could receive if he chose to rent out his showroom the salary sean could earn if he worked as a paralegal the wholesale cost for the boats that sean pays the

Answers: 2

You know the right answer?

The following monthly data are taken from ramirez company at july 31:

sales salaries,...

sales salaries,...

Questions

Mathematics, 16.02.2020 20:50

Mathematics, 16.02.2020 20:50

Mathematics, 16.02.2020 20:51

Mathematics, 16.02.2020 20:51

English, 16.02.2020 20:53

Chemistry, 16.02.2020 20:55

Mathematics, 16.02.2020 20:55

Mathematics, 16.02.2020 20:55

Health, 16.02.2020 20:57

Mathematics, 16.02.2020 20:57

Mathematics, 16.02.2020 21:01