Business, 21.01.2020 04:31 joshblubaugh

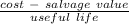

Amachine was purchased at a cost of $70,000. the equipment had an estimated useful life of eight years and a residual value of $6,000. assuming the equipment was sold at the end of year 6 for $14,000, determine the gain or loss on the sale of the equipment. (assume the straight-line depreciation method.)

Answers: 2

Another question on Business

Business, 21.06.2019 19:20

In 2007, americans smoked 19.2 billion packs of cigarettes. they paid an average retail price of $4.50 per pack. a. given that the elasticity of supply is 0.50.5 and the elasticity of demand is negative 0.4−0.4, derive linear demand and supply curves for cigarettes. the demand equation is qdequals=nothingplus+nothing times ×p and the supply equation is qsequals=nothingplus+nothing times ×p.

Answers: 2

Business, 21.06.2019 20:30

The federal act which provided over $7 billion to the epa to protect and promote "green" jobs and a healthier environment is the - national environmental policy act. - resource recovery act.- resource conservation and recovery act.- american recovery and reinvestment act. - clean air act.

Answers: 1

Business, 22.06.2019 04:10

What is the difference between secure bonds and naked bonds?

Answers: 1

Business, 22.06.2019 10:10

Rats that received electric shocks were unlikely to develop ulcers if the

Answers: 1

You know the right answer?

Amachine was purchased at a cost of $70,000. the equipment had an estimated useful life of eight yea...

Questions

Mathematics, 10.07.2019 11:30

Mathematics, 10.07.2019 11:30

Geography, 10.07.2019 11:30

History, 10.07.2019 11:30

Geography, 10.07.2019 11:30

Physics, 10.07.2019 11:30

Chemistry, 10.07.2019 11:30

Mathematics, 10.07.2019 11:30

Mathematics, 10.07.2019 11:30