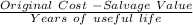

The straight-line depreciation method and double-declining balance depreciation method a. produce the same total depreciation over an asset's useful life b. produce the same depreciation expense each year c. produce the same book value each other d. are the only acceptable methods of depreciation for financial reporting e. are acceptable for tax purpose only.

Answers: 1

Another question on Business

Business, 22.06.2019 21:50

Which three of the following expenses can student aid recover? -tuition -television -school supplies -parties and socializing -boarding/housing

Answers: 2

Business, 23.06.2019 09:50

Leading guitar string producer wound up inc. has enjoyed a competitive advantage based on its proprietary coating that gives its strings a clearer sound and longer lifespan than uncoated strings. one of wound up's competitors, however, has recently developed a similar coating using less expensive ingredients, which allows it to charge a lower price than wound up for similar-quality strings. wound up's competitive advantage is in danger due to a. a lack of perceived value b. a lack of organization c. direct imitation and substitution d. resource immobility

Answers: 3

Business, 23.06.2019 10:10

Swain company manufactures one product, it does not maintain any beginning or ending inventories, and its uses a standard cost system. the company's beginning balance in retained earnings is $65,000. it sells one product for $170 per unit and it generated total sales during the period of $603,500 while incurring selling and administrative expenses of $54,500. swain company does not have any variable manufacturing overhead costs and its standard cost card for its only product is as follows:

Answers: 1

Business, 23.06.2019 13:20

Sam owns speedy bricklayers, inc., a company that specializes in bricklaying. to maintain his business's reputation for quick, quality bricklaying, sam requires that all employees are experienced bricklayers. this discriminates against potential employees who have never laid bricks before. sam is likely:

Answers: 2

You know the right answer?

The straight-line depreciation method and double-declining balance depreciation method a. produce th...

Questions

Mathematics, 24.05.2020 06:00

History, 24.05.2020 06:00

Mathematics, 24.05.2020 06:00

Mathematics, 24.05.2020 06:00

Chemistry, 24.05.2020 06:00

Mathematics, 24.05.2020 06:00

History, 24.05.2020 06:00

History, 24.05.2020 06:00

Arts, 24.05.2020 06:00

History, 24.05.2020 06:01

Chemistry, 24.05.2020 06:01

Mathematics, 24.05.2020 06:01

Computers and Technology, 24.05.2020 06:01

Mathematics, 24.05.2020 06:01