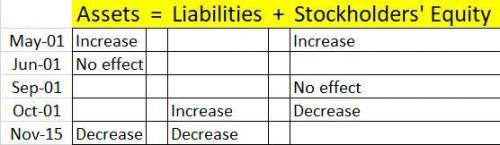

For each transaction, indicate the transaction's effect on the company's accounting equation by selecting either increase, decrease, or no effect for each area of the accounting equation. do not leave any of the fields below blank. (if the transaction were to cause an increase and decrease to the same area of the accounting equation, no effect should be chosen as the overall effect to that area) on may 1, issued 20,000 shares of $10 par common stock for $20 per share. on june 1, purchased 4,000 shares of treasury stock for $25 per share. on sept 1, declared a 4-for-1 stock split. on oct 1, declared a dividend of $10,000 to be paid on nov 15. on nov 15, paid the dividend previously declared on oct 1.

Answers: 2

Another question on Business

Business, 22.06.2019 08:30

In risk management, what does risk control include? a. risk identification b. risk analysis c. risk prioritization d. risk management planning e. risk elimination need this answer now : (

Answers: 3

Business, 22.06.2019 11:20

Which stage of group development involves members introducing themselves to each other?

Answers: 3

Business, 22.06.2019 15:00

Magic realm, inc., has developed a new fantasy board game. the company sold 15,000 games last year at a selling price of $20 per game. fixed expenses associated with the game total $182,000 per year, and variable expenses are $6 per game. production of the game is entrusted to a printing contractor. variable expenses consist mostly of payments to this contractor.required: 1-a. prepare a contribution format income statement for the game last year.1-b. compute the degree of operating leverage.2. management is confident that the company can sell 58,880 games next year (an increase of 12,880 games, or 28%, over last year). given this assumption: a. what is the expected percentage increase in net operating income for next year? b. what is the expected amount of net operating income for next year? (do not prepare an income statement; use the degree of operating leverage to compute your answer.)

Answers: 2

Business, 22.06.2019 20:10

Mikkelson corporation's stock had a required return of 12.50% last year, when the risk-free rate was 3% and the market risk premium was 4.75%. then an increase in investor risk aversion caused the market risk premium to rise by 2%. the risk-free rate and the firm's beta remain unchanged. what is the company's new required rate of return? (hint: first calculate the beta, then find the required return.) do not round your intermediate calculations.

Answers: 2

You know the right answer?

For each transaction, indicate the transaction's effect on the company's accounting equation by sele...

Questions

English, 02.07.2019 03:30

Biology, 02.07.2019 03:30

Mathematics, 02.07.2019 03:30

Mathematics, 02.07.2019 03:30

English, 02.07.2019 03:30

Computers and Technology, 02.07.2019 03:30

Mathematics, 02.07.2019 03:30

Mathematics, 02.07.2019 03:30

History, 02.07.2019 03:30

Mathematics, 02.07.2019 03:30

English, 02.07.2019 03:30

Geography, 02.07.2019 03:30