Answers: 1

Another question on Business

Business, 22.06.2019 11:30

Mark knopf is an auditor who has been asked to provide an audit and financial statement certification for a company that is going public on the new york stock exchange. knopf wants to know his personal liability if the company provides him with inaccurate or false information. which of the following sources of law will him answer that question? a. the city ordinances where the company headquarters is located. b. the state constitution of the state where the company is incorporated. c. code of federal regulations. d. all of the above

Answers: 1

Business, 22.06.2019 14:20

In canada, the reference base period for the cpi is 2002. by 2012, prices had risen by 21.6 percent since the base period. the inflation rate in canada in 2013 was 1.1 percent. calculate the cpi in canada in 2013. hint: use the information that “prices had risen by 21.6 percent since the base period” to find the cpi in 2012. use the inflation rate formula (inflation is the growth rate of the cpi) to find cpi in 2013, knowing the cpi in 2012 and the inflation rate. the cpi in canada in 2013 is round up your answer to the first decimal. 122.9 130.7 119.6 110.5

Answers: 1

Business, 22.06.2019 17:00

You hold a diversified $100,000 portfolio consisting of 20 stocks with $5,000 invested in each. the portfolio's beta is 1.12. you plan to sell a stock with b = 0.90 and use the proceeds to buy a new stock with b = 1.50. what will the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

You know the right answer?

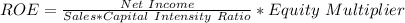

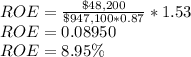

Bamp co. has net income of $48,200, sales of $947,100, a capital intensity ratio of .87, and an equi...

Questions

English, 12.12.2020 16:00

Mathematics, 12.12.2020 16:00

Mathematics, 12.12.2020 16:00

Chemistry, 12.12.2020 16:00

Mathematics, 12.12.2020 16:00

Mathematics, 12.12.2020 16:00

Mathematics, 12.12.2020 16:00

Mathematics, 12.12.2020 16:00

Mathematics, 12.12.2020 16:00

Health, 12.12.2020 16:00