Business, 10.02.2020 21:29 savskye1767

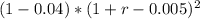

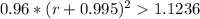

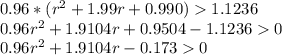

You are considering an investment in a mutual fund with a 4% load and expense ratio of 0.5%. You can invest instead in a bank CD paying 6% interest.

a. If you plan to invest for 2 years, what annual rate of return must the fund portfolio earn for you to be better off in the fund than in the CD?

Answers: 2

Another question on Business

Business, 21.06.2019 15:00

Which energy career pathways work with renewable energy? check all that apply.

Answers: 1

Business, 22.06.2019 09:40

The relationship requirement for qualifying relative requires the potential qualifying relative to have a family relationship with the taxpayer. t or fwhich of the following is not a from agi deduction? a.standard deductionb.itemized deductionc.personal exemptiond.none of these. all of these are from agi deductions

Answers: 3

Business, 22.06.2019 12:10

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

Business, 22.06.2019 17:30

Danielle enjoys working as a certified public accountant (cpa) and assisting small businesses and individuals with managing their finances and taxes. which general area of accounting is her specialty? danielle specialized in

Answers: 1

You know the right answer?

You are considering an investment in a mutual fund with a 4% load and expense ratio of 0.5%. You can...

Questions

History, 19.03.2021 20:40

Mathematics, 19.03.2021 20:40

Biology, 19.03.2021 20:40

Spanish, 19.03.2021 20:40

Chemistry, 19.03.2021 20:40

History, 19.03.2021 20:40

Mathematics, 19.03.2021 20:40

English, 19.03.2021 20:40