Business, 11.02.2020 00:50 isaiahdunn

In Chapter 1, you learned that buying and selling textbooks are two separate decisions made at the margin. Textbooks create value both when they are bought and when they are sold.

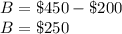

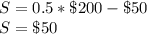

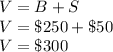

Think about your decision to buy the textbook for this course. You paid $200 for the book, but you would have been willing to pay $450 to use the book for the semester. Suppose that at the end of the semester you could keep your textbook or sell it back to the bookstore. Once you have completed the course, the book is worth only $50 to you. The bookstore will pay you 50% of the original $200.

How much total value have you gained?

Answers: 3

Another question on Business

Business, 22.06.2019 09:30

When you hire an independent contractor you don't have to pay the contractors what

Answers: 3

Business, 22.06.2019 11:20

Money aggregates identify whether each of the following examples belongs in m1 or m2. if an example belongs in both, be sure to check both boxes. example m1 m2 gilberto has a roll of quarters that he just withdrew from the bank to do laundry. lorenzo has $25,000 in a money market account. neha has $8,000 in a two-year certificate of deposit (cd).

Answers: 3

Business, 22.06.2019 13:40

Jacob is a member of wcc (an llc taxed as a partnership). jacob was allocated $155,000 of business income from wcc for the year. jacob’s marginal income tax rate is 37 percent. the business allocation is subject to 2.9 percent of self-employment tax and 0.9 percent additional medicare tax. (round your intermediate calculations to the nearest whole dollar a) what is the amount of tax jacob will owe on the income allocation if the income is not qualified business income? b) what is the amount of tax jacob will owe on the income allocation if the income is qualified business income (qbi) and jacob qualifies for the full qbi duduction?

Answers: 2

Business, 22.06.2019 16:40

Job 456 was recently completed. the following data have been recorded on its job cost sheet: direct materials $ 2,418 direct labor-hours 74 labor-hours direct labor wage rate $ 13 per labor-hour machine-hours 137 machine-hours the corporation applies manufacturing overhead on the basis of machine-hours. the predetermined overhead rate is $14 per machine-hour. the total cost that would be recorded on the job cost sheet for job 456 would be: multiple choice $3,380 $5,298 $6,138 $2,622

Answers: 1

You know the right answer?

In Chapter 1, you learned that buying and selling textbooks are two separate decisions made at the m...

Questions

History, 25.11.2020 14:00

French, 25.11.2020 14:00