Business, 11.02.2020 01:53 4300252063

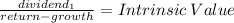

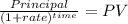

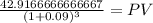

Martin's Inc. is expected to pay annual dividends of $2.50 a share for the next three years. After that, dividends are expected to increase by 3% annually. What is the current value of this stock to you if you require a 9% rate of return on this investment?

Answers: 3

Another question on Business

Business, 21.06.2019 23:10

Kando company incurs a $9 per unit cost for product a, which it currently manufactures and sells for $13.50 per unit. instead of manufacturing and selling this product, the company can purchase product b for $5 per unit and sell it for $12 per unit. if it does so, unit sales would remain unchanged and $5 of the $9 per unit costs assigned to product a would be eliminated. 1. prepare incremental cost analysis. should the company continue to manufacture product a or purchase product b for resale? (round your answers to 2 decimal places.)

Answers: 1

Business, 22.06.2019 21:30

Abond purchased for $950 was sold for $980 after one year. the interest received during the year is $25. the bond's yield is:

Answers: 1

Business, 22.06.2019 22:00

Exercise 2-12 cost behavior; high-low method [lo2-3, lo2-4] speedy parcel service operates a fleet of delivery trucks in a large metropolitan area. a careful study by the company’s cost analyst has determined that if a truck is driven 120,000 miles during a year, the average operating cost is 11.6 cents per mile. if a truck is driven only 80,000 miles during a year, the average operating cost increases to 13.6 cents per mile. required: 1.& 2. using the high-low method, estimate the variable and fixed cost elements of the annual cost of truck operation. (round the "variable cost per mile" to 3 decimal places.)

Answers: 3

Business, 22.06.2019 23:40

Gif the federal reserve did not regulate fiscal policy, monitor banks and provide services for banks, what would most likely be the economic conditions to transact business in the u.s.? the economy would primarily be based on a barter system rather than a fiat system. there would be no discrimination in lending by local banks. the economy would be less efficient and transactions most likely more costly.

Answers: 1

You know the right answer?

Martin's Inc. is expected to pay annual dividends of $2.50 a share for the next three years. After t...

Questions

Mathematics, 13.04.2021 22:40

Social Studies, 13.04.2021 22:40

Mathematics, 13.04.2021 22:40

Social Studies, 13.04.2021 22:40

History, 13.04.2021 22:40

English, 13.04.2021 22:40

Mathematics, 13.04.2021 22:40

Biology, 13.04.2021 22:40