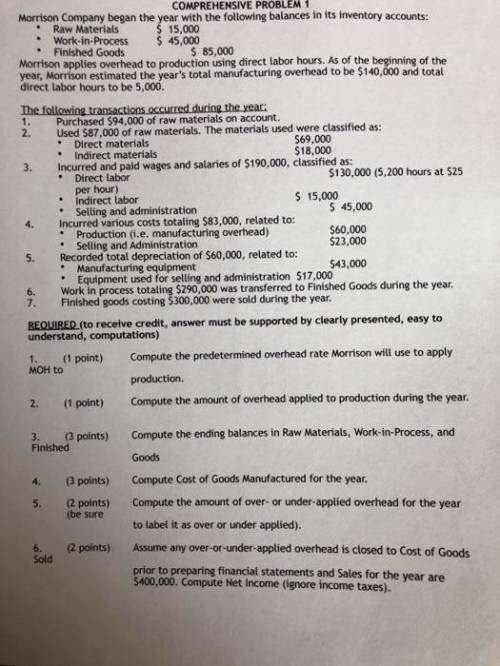

Morrison Company began the year with the following balances in its inventory accounts: Raw Materials $ 15,000 Work‐in‐Process $ 45,000 Finished Goods $ 85,000 Morrison applies overhead to production using direct labor hours. As of the beginning of the year, Morrison estimated the year’s total manufacturing overhead to be $140,000 and total direct labor hours to be 5,000. The following transactions occurred during the year: 1. Purchased $94,000 of raw materials on account. 2. Used $87,000 of raw materials. The materials used were classified as: Direct materials $69,000 Indirect materials $18,000 3. Incurred and paid wages and salaries of $190,000, classified as: Direct labor $130,000 (5,200 hours at $25 per hour) Indirect labor $ 15,000 Selling and administration $ 45,000 4. Incurred various costs totaling $83,000, related to: Production (i. e. manufacturing overhead) $60,000 Selling and Administration $23,000 5. Recorded total depreciation of $60,000, related to: Manufacturing equipment $43,000 Equipment used for selling and administration $17,000 6. Work in process totaling $290,000 was transferred to Finished Goods during the year. 7. Finished goods costing $300,000 were sold during the year.

Answers: 2

Another question on Business

Business, 22.06.2019 20:10

The gilbert instrument corporation is considering replacing the wood steamer it currently uses to shape guitar sides. the steamer has 6 years of remaining life. if kept,the steamer will have depreciaiton expenses of $650 for five years and $325 for the sixthyear. its current book value is $3,575, and it can be sold on an internet auction site for$4,150 at this time. if the old steamer is not replaced, it can be sold for $800 at the endof its useful life. gilbert is considering purchasing the side steamer 3000, a higher-end steamer, whichcosts $12,000 and has an estimated useful life of 6 years with an estimated salvage value of$1,500. this steamer falls into the macrs 5-year class, so the applicable depreciationrates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. the new steamer is fasterand allows for an output expansion, so sales would rise by $2,000 per year; the newmachine's much greater efficiency would reduce operating expenses by $1,900 per year.to support the greater sales, the new machine would require that inventories increase by$2,900, but accounts payable would simultaneously increase by $700. gilbert's marginalfederal-plus-state tax rate is 40%, and its wacc is 15%.a. should it replace the old steamer? b. npv of replace = $2,083.51

Answers: 2

Business, 22.06.2019 22:20

Which of the following best explains why the demand for housing is more flexible than the supply? a. new housing developments are being constructed all the time. b. low interest rates for mortgages make buying a home very affordable. c. the increasing population always drives demand upwards. d. people can move more easily than producers can build new homes.

Answers: 1

Business, 23.06.2019 07:30

Which of the following conditions might result in the best financial decisions? a. agreeableness b. openness c. conscientiousness d. extraversion

Answers: 1

Business, 23.06.2019 13:00

How should the financial interests of stockholders be balanced with varied interests of stakeholders? if you were writing a code of conduct for your company, how would you address this issue?

Answers: 1

You know the right answer?

Morrison Company began the year with the following balances in its inventory accounts: Raw Materia...

Questions

History, 10.03.2020 20:26

Mathematics, 10.03.2020 20:26

Mathematics, 10.03.2020 20:26