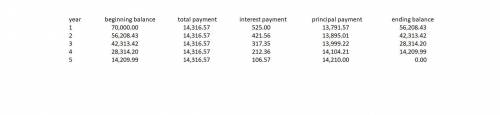

Prepare an amortization schedule for a five-year loan of $70,000. The interest rate is 9 percent per year, and the loan calls for equal annual payments. (Do not round intermediate calculations and round your answers to 2 decimal places, e. g., 32.16.) Year Beginning Balance Total Payment Interest Payment Principal Payment Ending Balance 1 $ $ $ $ $ 2 3 4 5 How much total interest is paid over the life of the loan? (Do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) Total interest paid $

Answers: 2

Another question on Business

Business, 22.06.2019 00:40

The silverside company is considering investing in two alternative projects: project 1 project 2 investment $500,000 $240,000 useful life (years) 8 7 estimated annual net cash inflows for useful life $120,000 $40,000 residual value $32,000 $10,000 depreciation method straightminusline straightminusline required rate of return 11% 8% what is the accounting rate of return for project 2? (round any intermediary calculations to the nearest dollar, and round your final answer to the nearest hundredth of a percent, x.xx%.)

Answers: 3

Business, 22.06.2019 08:40

Which of the following statements is true regarding the reporting of outside interests and the management of conflicts? investigators are responsible for developing their own management plans for significant financial interests. the institution must report identified financial conflicts of interest to the u.s. office of research integrity. investigators must disclose their significant financial interests related to their institutional responsibilities and not just those related to a particular project. investigators must disclose all of their financial interests regardless of whether they are related to a research project.

Answers: 3

Business, 22.06.2019 12:30

True or false entrepreneurs try to meet the needs of the marketplace by supplying a service or product

Answers: 1

Business, 22.06.2019 14:20

Frugala is when sylvestor puts $2,000 into 10-year state bonds and $3,000 into 5-year aaa-rated bonds in steady hand hardware, inc. he buys the four state bonds at a 5 percent interest rate and the three steady hand bonds at a 6.5 percent rate. sylvestor also buys $1,500 worth of blue chip stocks, and $800 worth of stock in a promising new sportswear company that reinvests its earnings in new growth. 1. (a) what is the maturity for each of the bond groups sylvestor buys? (b) the coupon rate? (c) the par value?

Answers: 3

You know the right answer?

Prepare an amortization schedule for a five-year loan of $70,000. The interest rate is 9 percent per...

Questions

Mathematics, 18.03.2021 18:50

English, 18.03.2021 18:50

Mathematics, 18.03.2021 18:50

Mathematics, 18.03.2021 18:50

History, 18.03.2021 18:50

Mathematics, 18.03.2021 18:50

Mathematics, 18.03.2021 18:50