Business, 12.02.2020 05:27 TMeansStupidity

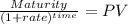

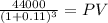

On January 1, 2018, Byner Company purchased a used tractor Byner paid $3,000 down and signed a noninterest-bearing note requiring $44,000 to be paid on December 31, 2020. The fair value of the tractor is not determinable. An interest rate of11% property reflects the time value of money for this type of loan agreement. The company's fiscal year-end is December 31.

Required:

1. Prepare the journal entry to record the acquisition of the tractor.

2. How much interest expense will the company include in its 2018 and 2019 income statements for this note?

3. What is the amount of the liability the company will report in its 2018 and 2019 balance sheets for this note?

Answers: 3

Another question on Business

Business, 22.06.2019 11:10

Sam and diane are completing their federal income taxes for the year and have identified the amounts listed here. how much can they rightfully deduct? • agi: $80,000 • medical and dental expenses: $9,000 • state income taxes: $3,500 • mortgage interest: $9,500 • charitable contributions: $1,000.

Answers: 1

Business, 22.06.2019 19:00

20. to add body to a hearty broth, you may use a. onions. b. pasta. c. cheese. d. water.

Answers: 2

Business, 22.06.2019 20:30

Blue computers, a major pc manufacturer in the united states, currently has plants in kentucky and pennsylvania. the kentucky plant has a capacity of 1 million units a year and the pennsylvania plant has a capacity of 1.5 million units a year. the firm divides the united states into five markets: northeast, southeast, midwest, south, and west. each pc sells for $1,000. the firm anticipates a 50 perc~nt growth in demand (in each region) this year (after which demand will stabilize) and wants to build a plant with a capacity of 1.5 million units per year to accommodate the growth. potential sites being considered are in north carolina and california. currently the firm pays federal, state, and local taxes on the income from each plant. federal taxes are 20 percent of income, and all state and local taxes are 7 percent of income in each state. north carolina has offered to reduce taxes for the next 10 years from 7 percent to 2 percent. blue computers would like to take the tax break into consideration when planning its network. consider income over the next 10 years in your analysis. assume that all costs remain unchanged over the 10 years. use a discount factor of 0.1 for your analysis. annual fixed costs, production and shipping costs per unit, and current regional demand (before the 50 percent growth) are shown in table 5-13. (a) if blue computers sets an objective of minimizing total fixed and variable costs, where should they build the new plant? how should the network be structured? (b) if blue computers sets an objective of maximizing after-tax profits, where should they build the new plant? how should the network be structured? variable production and shipping cost ($/unit) annual fixed cost northeast southeast midwest south west (million$) kentucky 185 180 175 175 200 150 pennsylvania 170 190 180 200 220 200 n. carolina 180 180 185 185 215 150 california 220 220 195 195 175 150 demand ('000 units/month) 700 400 400 300 600

Answers: 3

Business, 22.06.2019 23:30

At the save the fish nonprofit organization, jenna is responsible for authorizing outgoing payments, rob takes care of recording the payments in the organization's computerized accounting system, and shannon reconciles the organization's bank statements each month. this internal accounting control is best known as a(n) a. distribution process. b. segregation of duties c. specialized budget d. annotated financial process

Answers: 2

You know the right answer?

On January 1, 2018, Byner Company purchased a used tractor Byner paid $3,000 down and signed a nonin...

Questions

Physics, 30.09.2019 11:30

Geography, 30.09.2019 11:30

Chemistry, 30.09.2019 11:30

History, 30.09.2019 11:30

Mathematics, 30.09.2019 11:30

Mathematics, 30.09.2019 11:30

Chemistry, 30.09.2019 11:30

Mathematics, 30.09.2019 11:30

Mathematics, 30.09.2019 11:30

SAT, 30.09.2019 11:30

Geography, 30.09.2019 11:30

English, 30.09.2019 11:30