Business, 12.02.2020 18:17 wittlemarie

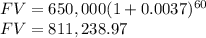

You purchase a house and take out a $650,000 loan with a 30-year term at 4.5% nominal annual interest rate (monthly compounding). If you pay off the loan at the end of 5 years (after your 60th payment) how much will you have to pay the bank at that time to the nearest penn?

Answers: 3

Another question on Business

Business, 22.06.2019 15:40

The cost of direct labor used in production is recorded as a? a. credit to work-in-process inventory account. b. credit to wages payable. c. credit to manufacturing overhead account. d. credit to wages expense.

Answers: 2

Business, 22.06.2019 17:30

Danielle enjoys working as a certified public accountant (cpa) and assisting small businesses and individuals with managing their finances and taxes. which general area of accounting is her specialty? danielle specialized in

Answers: 1

Business, 22.06.2019 19:00

12. to produce a textured purée, you would use a/an a. food processor. b. wide-mesh sieve. c. immersion blender d. food mill.

Answers: 1

Business, 22.06.2019 19:50

Ichelle is attending college and has a part-time job. once she finishes college, michelle would like to relocate to a metropolitan area. she wants to build her savings so that she will have a "nest egg" to start her off. michelle works out her budget and decides she can afford to set aside $9090 per month for savings. her bank will pay her 4 %4% per year, compounded monthly, on her savings account. what will be michelle's balance in five years?

Answers: 3

You know the right answer?

You purchase a house and take out a $650,000 loan with a 30-year term at 4.5% nominal annual interes...

Questions

English, 12.02.2020 05:01

Mathematics, 12.02.2020 05:01

Computers and Technology, 12.02.2020 05:01

Mathematics, 12.02.2020 05:02