Answers: 1

Another question on Business

Business, 21.06.2019 17:40

Which of the following is the least risky? collectables stock savings bond savings account

Answers: 2

Business, 21.06.2019 23:30

Highland company produces a lightweight backpack that is popular with college students. standard variable costs relating to a single backpack are given below

Answers: 1

Business, 22.06.2019 03:30

Diversified semiconductors sells perishable electronic components. some must be shipped and stored in reusable protective containers. customers pay a deposit for each container received. the deposit is equal to the container’s cost. they receive a refund when the container is returned. during 2018, deposits collected on containers shipped were $856,000. deposits are forfeited if containers are not returned within 18 months. containers held by customers at january 1, 2018, represented deposits of $587,000. in 2018, $811,000 was refunded and deposits forfeited were $41,000. required: 1. prepare the appropriate journal entries for the deposits received and returned during 2018. 2. determine the liability for refundable deposits to be reported on the december 31, 2018, balance sheet.

Answers: 1

Business, 22.06.2019 08:00

Why do police officers get paid less than professional baseball players?

Answers: 2

You know the right answer?

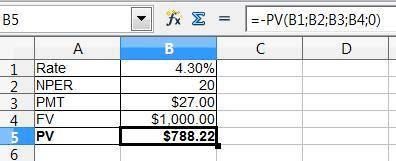

Compute the price of a 5.4 percent coupon bond with 10 years left to maturity and a market interest...

Questions

Mathematics, 24.04.2020 08:52

History, 24.04.2020 08:52

Mathematics, 24.04.2020 08:54

Mathematics, 24.04.2020 08:54

History, 24.04.2020 08:54

Mathematics, 24.04.2020 08:54

Mathematics, 24.04.2020 08:54

Mathematics, 24.04.2020 08:54

Mathematics, 24.04.2020 08:54

Mathematics, 24.04.2020 08:54

Mathematics, 24.04.2020 08:54

Mathematics, 24.04.2020 08:55

History, 24.04.2020 08:55