Business, 14.02.2020 20:12 melissapulido198

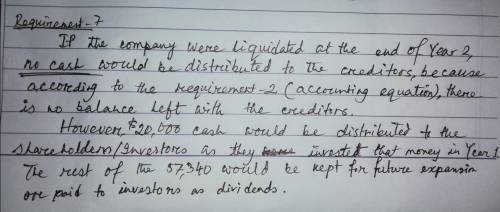

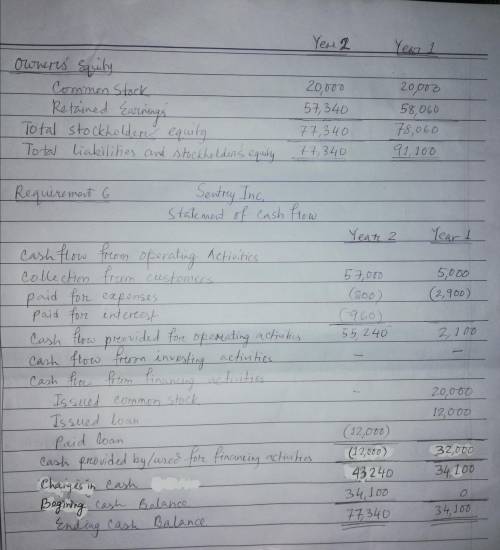

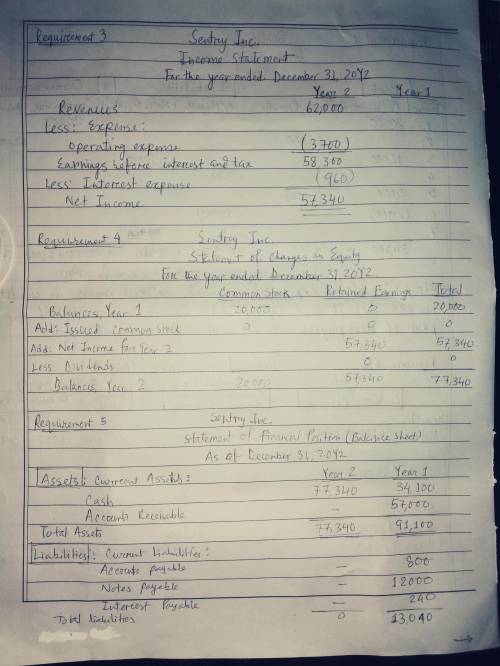

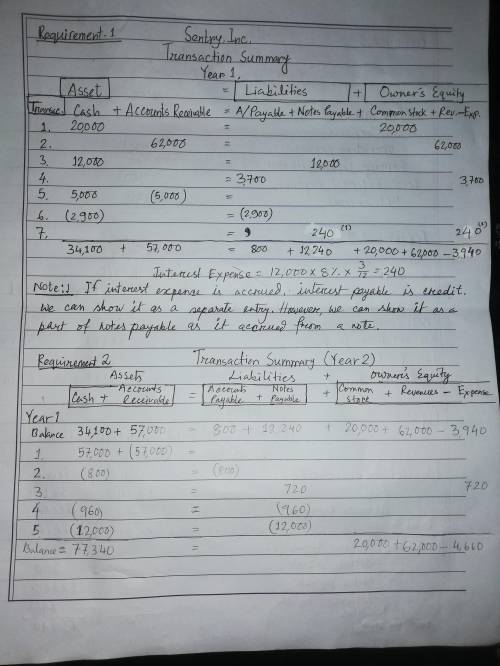

Sentry, Inc. was started on January 1, Year 1 Year 1 Transactions 1. Acquired $20,000 cash by issuing common stock 2. Earned $62,000 of revenue on account. 3. On October 1, Year 1, borrowed $12,000 cash from the local bank. 4. Incurred $3,700 of operating expenses on accoumt. 5. Collected $5,000 cash from accounts receivable. 6. Paid $2,900 cash to pay off a portion of the accounts payable. 7. On December 31, Year 1, Sentry recognized accrued interest expense. The note had a one-year term and an 8 percent annual interest rate. Year 2 Transactions 1. Collected cash for the remaining balance in accounts receivable. 2. Paid cash to settle the remaining balance of accounts payable. 3. On September 30, Year 2, recognized accrued interest expense. 4. On September 30, Year 2, paid cash to settle the balance of the interest payable account 5. On September 30, Year 2, paid cash to settle the notes payable. Required a. Record the events for Year 1 and Year 2 in an accounting equation. At the end of Year 1, total the columns to determine the Year 1 account balances. The Year 1 ending balances become the Year 2 beginning balances. At the end of Year 2, total the columns to determine the account balances for Year 2. b. Prepare an income statement, a statement of changes in stockholders' equity, a balance sheet, and a statement of cash flows for Year 1 and Year 2 c. If the company were liquidated at the end of Year 2, how much cash would be distributed to creditors? How much cash would be distributed to investors?

Answers: 1

Another question on Business

Business, 21.06.2019 23:30

As manager of kids skids, meghan wants to develop her relationship management skills. in order to do this, she learns how to

Answers: 2

Business, 22.06.2019 00:40

The silverside company is considering investing in two alternative projects: project 1 project 2 investment $500,000 $240,000 useful life (years) 8 7 estimated annual net cash inflows for useful life $120,000 $40,000 residual value $32,000 $10,000 depreciation method straightminusline straightminusline required rate of return 11% 8% what is the accounting rate of return for project 2? (round any intermediary calculations to the nearest dollar, and round your final answer to the nearest hundredth of a percent, x.xx%.)

Answers: 3

Business, 22.06.2019 14:20

Your uncle borrows $53,000 from the bank at 11 percent interest over the nine-year life of the loan. use appendix d for an approximate answer but calculate your final answer using the formula and financial calculator methods. what equal annual payments must be made to discharge the loan, plus pay the bank its required rate of interest

Answers: 1

You know the right answer?

Sentry, Inc. was started on January 1, Year 1 Year 1 Transactions 1. Acquired $20,000 cash by issuin...

Questions

Mathematics, 24.01.2021 23:40

Mathematics, 24.01.2021 23:40

Mathematics, 24.01.2021 23:40

English, 24.01.2021 23:40

History, 24.01.2021 23:40

Mathematics, 24.01.2021 23:40

Mathematics, 24.01.2021 23:40

Computers and Technology, 24.01.2021 23:40

Mathematics, 24.01.2021 23:40

Mathematics, 24.01.2021 23:40