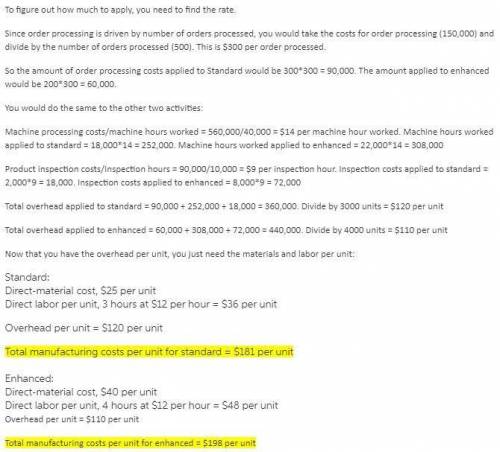

Ontario, Inc. manufactures two products, Standard and Enhanced, and applies overhead on the basis of direct-laborhours. Anticipated overhead and direct-labor time for the upcoming accounting period are $800,000 and 25,000 hours. respectively. Information about the company's products follows. Standard:Estimated production volume, 3.000 unitsDirect-material cost. $25 per unitDirect labor per unit, 3 hours at 512 per hourEnhanced:Estimated production volume, 4.000 unitsDirect-material cost. $40 per unitDirect labor per unit, 4 hours at S 12 per hourOntario’s overhead of $800,000 can be identified with three major activities: order processing ($150,000), machineprocessing ($560,000), and product inspection ($90,000). These activities are driven by number of orders processed, machine hours worked, and inspection hours, respectively. Data relevant to these activities follow. Top management is very concerned about declining profitability despite a healthy increase in sales volume. The decreasein income is especially puzzling because the company recently undertook a massive plant renovation during which new, highly automated machinery was installed-machinery that was expected to produce significant operating efficiencies. Requlred:1. Assuming use of direct-labor hours to apply overhead to production, compute the unit manufacturing costs of theStandard and Enhanced products if the expected manufacturing volume is attained.2. Assuming use of activity-based costing, compute the unit manufacturing costs of the Standard and Enhanced productsif the expected manufacturing volume is attained.3. Ontario’s selling prices are based heavily on cost. a. By using direct-labor hours as an application base, which product is over costed and which product is under costed?Calculate the amount of the cost distortion for each product. b .Is it possible that over costing and under costing Ge" cost distortion) and the subsequent determination of sellingprices are contributing to the company's profit woes? Explain.4. Build a spreadsheet: Construct an Excel spreadsheet to solve requirements 1, Z and 3(a )above. Show how the solutionwill change ifthe following data change: the overhead associated with order processing is 5300000 and the overheadassociated with product inspection is $270,000.

Answers: 2

Another question on Business

Business, 22.06.2019 01:20

What cylinder head operation is the technician performing in this figure?

Answers: 1

Business, 22.06.2019 04:30

4. the condition requires that only one of the selected criteria be true for a record to be displayed.

Answers: 1

Business, 23.06.2019 02:30

Complete electronics inc. sells a point-of-sale computer with a two-year service contract. complete collects $ 2 comma 500 cash for the selling price of the computer and $ 576 for the two-year service contract. how is revenue recognized?

Answers: 2

Business, 23.06.2019 13:30

Everfi module 5 answers when planning for college, you should consider:

Answers: 3

You know the right answer?

Ontario, Inc. manufactures two products, Standard and Enhanced, and applies overhead on the basis of...

Questions

Mathematics, 30.10.2021 01:30

Chemistry, 30.10.2021 01:30

Mathematics, 30.10.2021 01:40

Biology, 30.10.2021 01:40

English, 30.10.2021 01:40

Mathematics, 30.10.2021 01:40