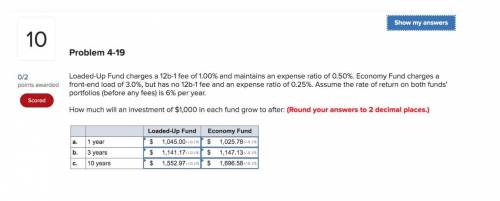

Loaded-Up Fund charges a 12b-1 fee of 1.00% and maintains an expense ratio of 0.50%. Economy Fund charges a front-end load of 3.0%, but has no 12b-1 fee and an expense ratio of 0.25%. Assume the rate of return on both funds’ portfolios (before any fees) is 12% per year. How much will an investment in each grow to after 1 year?

Answers: 1

Another question on Business

Business, 21.06.2019 15:30

Last week, linda's commission check was $84. if she earns a 12.5% commission on sales, what were her total sales?

Answers: 2

Business, 21.06.2019 15:50

Aceramics manufacturer sold cups last year for $7.50 each. variable costs of manufacturing were $2.25 per unit. the company needed to sell 20,000 cups to break even. net income was $5,040. this year, the company expects the price per cup to be $9.00; variable manufacturing costs to increase 33.3%; and fixed costs to increase 10%. how many cups (rounded) does the company need to sell this year to break even?

Answers: 2

Business, 22.06.2019 15:30

Careers in designing, planning, managing, building and maintaining the built environment can be found in the following career cluster: a. agriculture, food & natural resources b. architecture & construction c. arts, audio-video technology & communications d. business, management & administration

Answers: 2

Business, 22.06.2019 16:10

Regarding the results of a swot analysis, organizational weaknesses are (a) internal factors that the organization may exploit for a competitive advantage (b) internal factors that the organization needs to fix in order to be competitive (c) mbo skills that should be emphasized (d) skills and capabilities that give an industry advantages problems that a specific industry needs to correct

Answers: 1

You know the right answer?

Loaded-Up Fund charges a 12b-1 fee of 1.00% and maintains an expense ratio of 0.50%. Economy Fund ch...

Questions

Mathematics, 16.07.2020 18:01

Mathematics, 16.07.2020 18:01

Mathematics, 16.07.2020 18:01

Law, 16.07.2020 18:01

Mathematics, 16.07.2020 18:01

Mathematics, 16.07.2020 18:01

English, 16.07.2020 18:01

Computers and Technology, 16.07.2020 18:01

Physics, 16.07.2020 18:01

Physics, 16.07.2020 18:01